CAGR Insights is a weekly newsletter full of insights from around the world of the web.

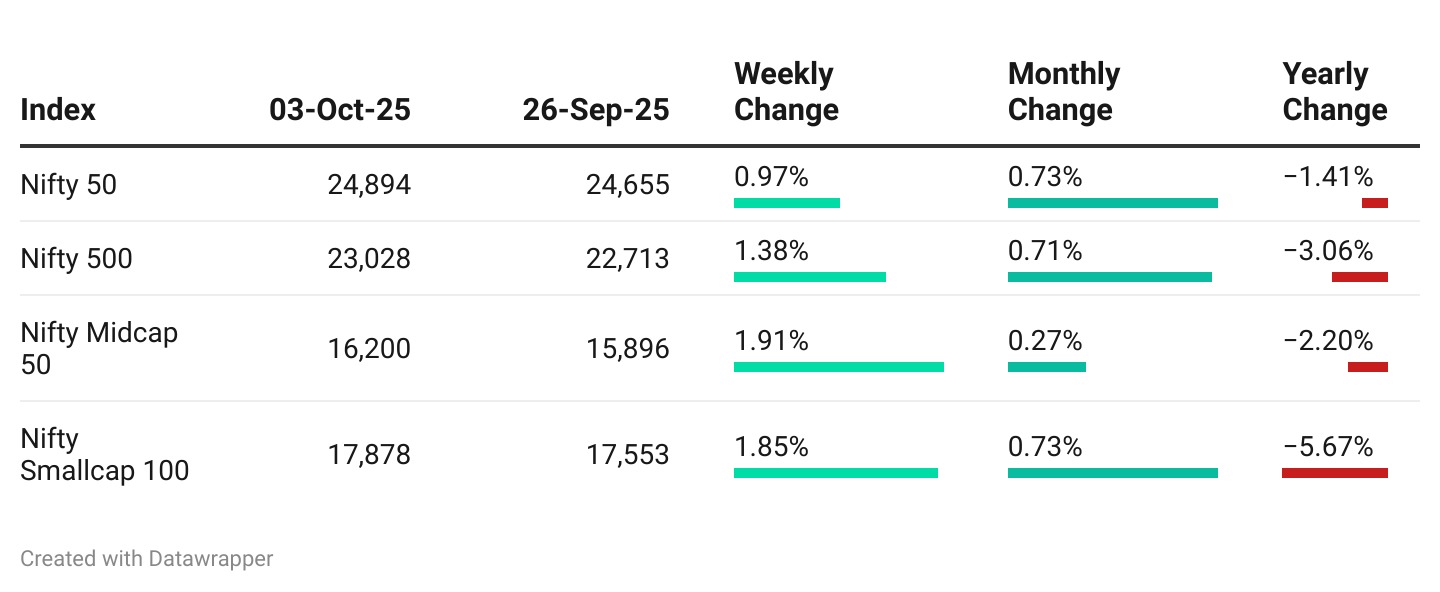

Chart Ki Baat

Gyaan Ki Baat

From Good to Extraordinary: The Power of Margin Expansion

As investors, we often chase growth—top-line numbers, market share, or flashy sector stories. But true wealth creation frequently lies in something subtler: margin expansion. At first glance, it seems obvious companies that earn more from the same sales should deliver better returns. Yet this simple idea can transform a good business into an extraordinary wealth compounding machine.

Margin expansion is more than just numbers; it reflects competitive advantage. It often signals that a company has strengthened its position—through better products, scale-driven pricing power, or operational efficiency. When these advantages are sustainable, compounding accelerates. Ordinary growth stories suddenly become unstoppable forces for wealth creation.

The challenge for investors lies in timing and discernment. Margin gains from temporary cycles—commodity price swings or short-term cost savings—can be misleading. The real prize is structural expansion, where higher margins are a result of deliberate strategy and improved capital efficiency.

Spotting these opportunities requires both analysis and intuition. Numbers alone won’t reveal the turning point; you must read between the lines, understand the business, and anticipate change before the market fully prices it in.

In a market like India, growth is abundant. The differentiator is quality of growth. Margin expansion is its fuel—a rare lever that can turn good investments into extraordinary ones. For patient investors willing to look closely, the rewards can be transformative.

In short: growth gets you started, but margin expansion drives compounding—and compounding drives wealth.

Personal Finance

- How would Sebi’s validated UPI handles make digital payments safer for investors? Validated handles are introduced as an additional payment option for investors. This compliments existing payment modes, allowing investors the flexibility to continue using the method they are most comfortable with. Read here

- NPS gets major overhaul: 100% equity option, shorter lock-ins, more choice: NPS upgrades from October 1, 2025, offer 100% equity, multiple schemes, and a 15-year vesting period. Discover how these changes give younger investors growth, flexibility, and smarter retirement options. Read here

- How Festive Spending Habits Are Reshaping Investment Decisions in Indian Households: While festivals will always be about tradition and celebration, channelling a part of that festive budget into investments can help fast-track critical goals, such as your children’s education or retirement. Read here

Investing

- Top 5 mistakes investors make in volatile markets: Common investing mistakes—panic selling, market timing, ignoring diversification, halting SIPs, and losing sight of goals—can cost you big. Discover how simple strategies can protect and grow your wealth over time. Read here

- Rate Cuts Near All-Time Highs: Impact on Stocks and Gold: When rate cuts occur near all-time highs, history shows double-digit gains in S&P 500 and gold, with gold potentially rising 30%. Emerging markets often lag, making balanced portfolios with gold and equities crucial for protection and growth. Read here

- The Millionaire’s Dilemma: Becoming a millionaire isn’t just about money—it’s about freedom. Hitting $1M gives options, choices, and control over your life. How will you use your wealth to shape your future? Read here

Economy & Sector

- India’s Economy Steered by Robust Consumption, Investments, Low Inflation, Favourable Food Prices & GST Reforms: Strong policy support, structural reforms, and a vibrant services sector are further reinforcing the growth outlook. These projections highlight broad confidence in India’s ability to sustain high growth amidst global challenges. Read here

- US government shutdown: What it means and how it will impact India’s economy and markets: The U.S. government shutdown affects 1.6 million federal workers, slows services, and creates market volatility. India faces potential IT delays and export impacts, highlighting the need for diversified portfolios and global awareness. Read here

- How Did India Maintain Economic Momentum In April–September Amid Tariff Stress? India’s economy shows strong H1 FY26 growth, driven by consumption, investment, public spending, and structural reforms. RBI keeps repo at 5.5%, GDP projected at 6.8%, with robust domestic demand and global confidence. Read here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.