CAGR Insights is a weekly newsletter full of insights from around the world of the web.

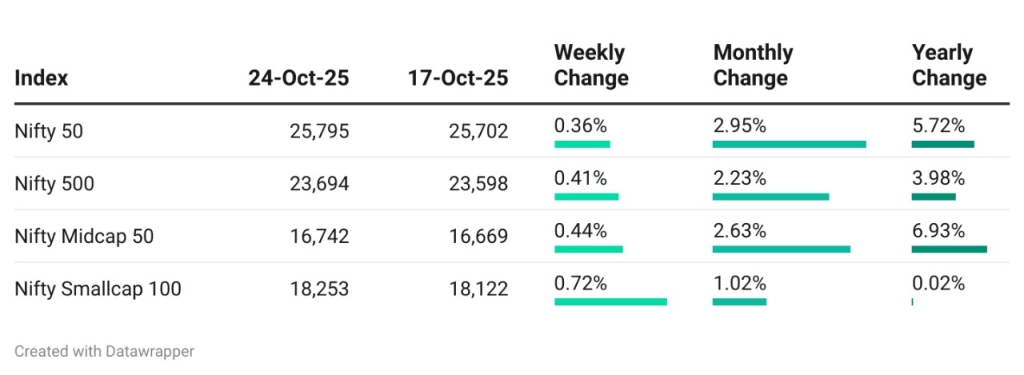

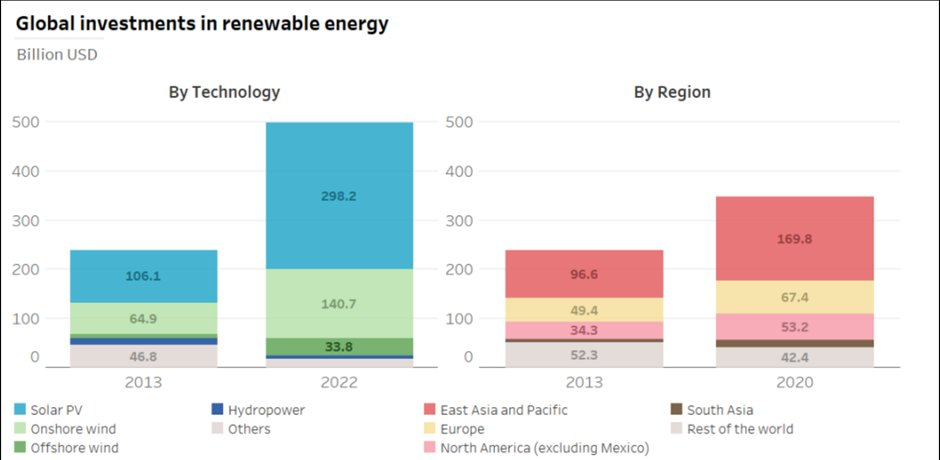

Chart Ki Baat

Gyaan Ki Baat

When SIPs Aren’t Enough: Why Your Real Safety Net Isn’t Just Investments

Rahul, 35, was confident about his financial future. Every month, without fail, he invested Rs 50,000 in equity mutual funds through systematic investment plans (SIPs). “Compounding will make me rich by 50,” he would proudly tell his friends.

But life had other plans. One day, his company downsized, and Rahul was handed a pink slip. Suddenly, those SIPs that once symbolized smart investing became a heavy burden. His next EMI was due in a week. His father’s medical bills piled up. His son’s school fees were pending. The only option seemed to be redeeming his equity funds, just when markets were volatile.

The harsh truth hit Rahul: while SIPs grow wealth over time, they aren’t designed to protect you in a financial emergency. What he really needed was liquidity, money he could access immediately without losing value in a downturn.

The Takeaway:

- SIPs are powerful for long-term wealth creation, but they aren’t your emergency fund.

- Always maintain 3–6 months of living expenses in liquid assets.

- Investments should complement, not replace, your financial safety net.

In short: SIPs build wealth, but emergency funds protect it. Don’t let life’s curveballs catch you off guard.

Personal Finance

- Global Diversification: The Rise of Country Investing Among the Wealthy: The 2025 Henley & Partners Global Investment Risk & Resilience Index shows wealthy families shifting from traditional assets to “sovereign diversification.” By securing second passports in resilient nations like Switzerland and Singapore, investors safeguard wealth, mobility, and stability — making resilience the new cornerstone of global wealth strategy. Read here

- Home Loan Rates in October: Leading Banks Offer Between 7.35% and 10.25%: Home loan rates in October remain stable, ranging from 7.35% to 10%. Public sector banks like SBI and Bank of Baroda offer rates starting around 7.45%, while private banks and HFCs such as ICICI, HDFC, and LIC Housing Finance provide competitive options beginning at 7.45%, catering to diverse borrowers. Read here

- Post-Diwali Money Detox: A 7-Day Challenge to Reset Your Financial Habits: The 7-day post-Diwali money detox helps reset financial habits through daily steps — pausing non-essential spending, auditing expenses, automating savings, cancelling unused subscriptions, prioritising debt repayment, resetting goals, and rewarding wisely. This structured approach builds lasting financial discipline, turning festive overspending into an opportunity for mindful money management and stability. Read here

Investing

- New Nominee Rules from November 1: What Multiple Nominations Mean for Bank Depositors: From November 1, depositors can nominate up to four persons for bank accounts, specifying their share to total 100%. Successive nominees become operative if the primary nominee passes away, while simultaneous nominations allow concurrent allocation. Lockers allow only successive nominees. The rules aim to reduce disputes and unclaimed deposits. Read here

- Are You Investing in Mutual Funds the Wrong Way?: Many mutual fund investors focus only on absolute returns, ignoring fund health and risk. Experts advise using XIRR for accurate annualised gains, assessing fund consistency, risk ratios, manager track record, and benchmarks. Regular, data-driven reviews help investors make informed decisions, prioritising steady, long-term wealth growth over short-term profits. Read here

- SEBI Prohibits Mutual Funds from Investing in Pre-IPO Placements: SEBI has barred mutual funds from investing in pre-IPO placements, allowing participation only in the anchor or public IPO portions. The move ensures compliance with regulations requiring investments in listed or soon-to-be-listed securities, strengthens investor protection, and prevents mutual funds from holding unlisted shares if IPOs are delayed or cancelled. Read here

Economy & Sector

- SEBI Prohibits Mutual Funds from Investing in Pre-IPO Placements: SEBI has barred mutual funds from investing in pre-IPO placements, allowing participation only in the anchor or public IPO portions. The move ensures compliance with regulations requiring investments in listed or soon-to-be-listed securities, strengthens investor protection, and prevents mutual funds from holding unlisted shares if IPOs are delayed or cancelled. Read here

- This Week’s Inflation Report Raises Questions Over Data Accuracy: The September CPI report faces scrutiny as the U.S. government shutdown affects data collection, raising investor scepticism. While forecasts predict modest inflation increases, missing or incomplete data could complicate Federal Reserve policy decisions. Despite expected rate cuts, analysts caution that limited information may hinder meaningful insights into economic trends. Read here

- FM Urges GST Authorities to Avoid Taxpayer Burden, Promote Tech-Driven Compliance: Finance Minister Nirmala Sitharaman urged GST authorities to avoid burdening taxpayers, advocating technology-driven, risk-based compliance. She announced a simplified GST registration from November 1 for faster approvals, emphasized data-led enforcement, timely CBIC disciplinary action, and linked next-gen GST reforms to efficiency, automation, and India’s development goals under Viksit Bharat 2047. Read here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.