CAGR Insights is a weekly newsletter full of insights from around the world of the web.

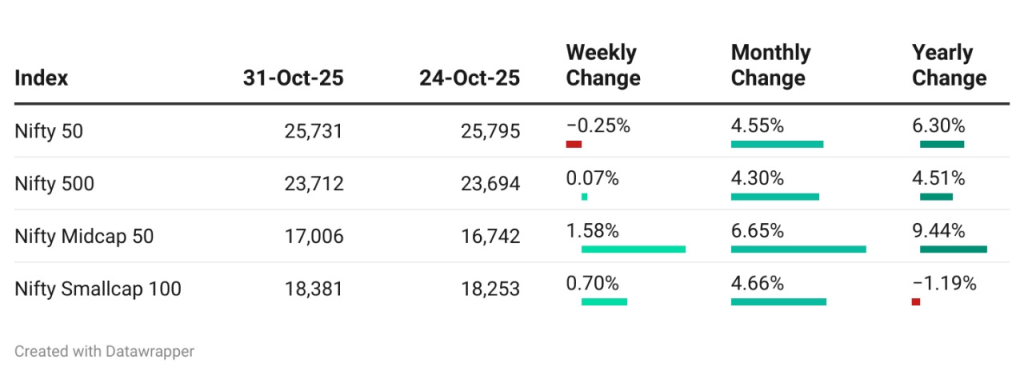

Chart ki Baat

Gyaan Ki Baat

Diwali and the Overspending Dilemma: Does Your Budget Vanish in the Festive Glow?

Every Diwali, lights aren’t the only things that sparkle — our expenses do too. From gifts and décor to travel and impulse purchases, spending often goes beyond expectations. It’s easy to justify these moments as “once a year” indulgences, but when unchecked, festive enthusiasm can derail long-term financial goals. Studies show that people tend to underestimate festive expenses by 20–30%, mainly because emotions take over rational budgeting during celebration-driven months.

A simple way to stay financially mindful is to plan your festive fund in advance. Parking a small amount monthly in arbitrage or liquid funds helps you accumulate a dedicated pool for seasonal spending without disturbing long-term investments. Discussing your estimated festive budget with your family and financial planner ensures accountability and clarity. It also allows better use of bonuses or incentives — instead of splurging everything, you can allocate a portion toward wealth creation and still enjoy guilt-free celebrations.

This Diwali, let your finances shine as bright as your diyas. Celebrate smartly, spend consciously, and invest purposefully — because true prosperity lies not just in earning more, but in spending with intention.

Personal Finance

- How Much SIP You Need to Reach ₹2 Crore by Retirement (at 10% & 12% Returns): Starting early with SIPs helps build a strong retirement corpus through the power of compounding. For a ₹2 crore goal, investing ₹20,217 monthly for 20 years at 12% or ₹33,302 at 10% can achieve the target. Longer investment tenures and consistent SIPs significantly reduce the monthly contribution required. Read here

- What’s Changing from November 1? Key Updates That May Impact Your Pocket: From November 1, 2025, key financial rule changes will impact daily expenses. Updates include new GST slabs, revised bank nomination rules, Aadhaar update charges, and pension submission deadlines. Additionally, PNB locker rents and SBI Card transaction fees are changing, potentially affecting savings and spending for individuals and households. Read here

- Claiming Capital Gains Exemptions: Is Dual Benefit Under Sections 54 and 54F Allowed?: A taxpayer can claim capital gains exemptions under both Sections 54 and 54F of the Income Tax Act for the same residential property, provided all conditions are met. Section 54 applies to gains from selling a house, while Section 54F applies to gains from other assets like mutual funds. Read here

Investing

- Shining Opportunity: Is Silver the Next Big Investment Bet?: Silver is experiencing a modern revival in India evolving from a traditional symbol of purity to a contemporary expression of design, sustainability, and accessible luxury. Once locked away, it now adorns homes and jewellery alike, blending emotional value with investment potential as artisans and investors rediscover its enduring beauty. Read here

- How to Build a Steady Monthly Income with ₹1.21 Crore and Your Future Earnings: A 37-year-old homemaker with ₹1.21 crore in various investments seeks steady income and optimisation of future earnings. Experts advise simplifying insurance to term plans, using equity index funds, RBI floating rate bonds, and deposits for income. For her mother’s plan, tweaking allocations and adding factor investing can enhance long-term returns. Read here

Economy & Sector

- Trump Denies Discussing Oil with Xi Amid Russian Oil Controversy: Trump avoided discussing China’s Russian oil imports during his meeting with Xi Jinping, despite criticizing India for the same. Experts say this weakens his sanctions on Moscow, as China remains a major buyer funding Russia’s war. Analysts suggest Trump prioritized US-China relations and trade deals over enforcing sanctions. Read here

- India Gets China’s Nod: Firms Licensed to Import Rare Earth Minerals: At least four Indian firms, Continental India, DE Diamond, Hitachi, and Jay Ushin have received Chinese licences to import rare earth magnets. The MEA also confirmed a six-month US sanctions waiver for India’s Chabahar port project, while India reviews implications of US-China rare earth and Russian energy developments. Read here

- Fed Trims Interest Rates Amid Uncertainty from US Government Shutdown: The Federal Reserve cut its key rate to 3.9%, its second reduction this year, to support growth amid a government shutdown that halted key economic data. With inflation still above target and job gains slowing, the Fed faces uncertainty over future moves while balancing growth and inflation risks. Read here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.