CAGR Insights is a weekly newsletter full of insights from around the world of the web.

Chart Ki Baat

Gyaan Ki Baat

Fix the Roof Before Picking Wall Colours

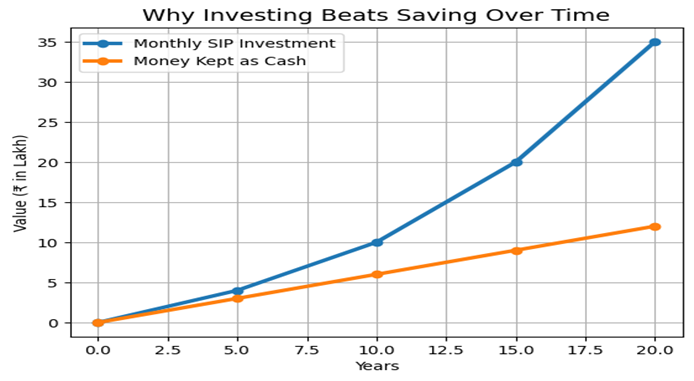

“Which mutual fund should I buy?” is often the wrong first question. Many investors rush into investing without fixing the basics—like emergency savings, insurance, or unmanaged debt. It’s like choosing wall colours while the roof is still leaking.

Investing is important but doing it without a strong financial foundation can quietly sabotage long-term wealth. Without protection and stability, even good investments can be derailed by life’s uncertainties.

The smarter approach is simple: secure your finances first, then invest with confidence.

Because wealth isn’t built by chasing products—it’s built on strong financial fundamentals.

Personal Finance

- Want a Happier Retirement? Build These 2 Simple Habits Now: Most retirement regrets come down to two things: starting too late and saving too little. Even small amounts saved early grow powerfully through compounding, while gradual increases in savings reduce future stress. With longer lifespans and rising healthcare costs, consistency today can mean freedom, security, and peace of mind tomorrow. Read more

- New NPS exit rules notified: PFRDA allows 80% withdrawal, 100% up to ₹8 lakh; PFRDA’s new NPS exit rules allow non-government subscribers to use only 20% of their corpus to buy an annuity after 15 years, retirement, or age 60. The remaining 80% can be withdrawn as lump sum or periodic payouts. Full withdrawal is allowed for amounts up to ₹8 lakh. Early exits require 80% annuity unless the corpus is ≤₹5 lakh. Subscribers can defer withdrawals or annuity purchase until age 85. Read more

- Investing for kids: Why starting early matters more than the returns: Investing for children isn’t just about education or weddings—it’s about starting early and letting time work its magic. Small, regular investments made early benefit from compounding, ride out market volatility, and offer flexibility for changing life paths. A dedicated child-focused portfolio builds discipline, reduces stress, and protects future choices long before big goals appear. Read more

Investing

- Is This How the AI Bubble Pops: Every bubble looks safe—until one core assumption breaks. Today, massive AI data centres are being funded via conduit debt, shifting risk away from Big Tech to investors like pension funds and insurers. If demand for compute ever slows or tech turns obsolete, these structures could crack—much like mortgage-backed securities once did—without killing AI itself. Read more

- Should You Buy at All-Time Highs? History Has Answer All-time highs feel risky, but data says otherwise. Buying near market peaks doesn’t meaningfully hurt long-term returns—and trying to time dips rarely works. Across stocks, gold, and even Bitcoin, all-time highs are often neutral or short-term bullish. The smarter move? Stay invested, rebalance calmly, and keep buying consistently. Read more

Economy & Sector

- Boom or Bust? What an AI Bubble Burst in the US Could Mean for Indian Markets: Rising concerns around an AI-driven valuation bubble in the US have intensified as stocks like Nvidia surge. A potential correction on Wall Street could spill over into global markets, including India. Indian equities may face short-term volatility, particularly in IT and tech-related stocks. However, relatively reasonable valuations, strong domestic demand, and sectoral diversification could help Indian markets withstand long-term damage despite temporary sentiment-driven corrections. Read more

- The Growth of Green Finance and its Impact on India’s Sustainable Development: Green finance is becoming central to India’s growth story, bridging economic development with environmental responsibility. From green bonds and ESG funds to renewable energy financing, it is enabling India’s transition to a low-carbon economy. Backed by strong policy support and rising investor awareness, green finance is accelerating clean energy, climate resilience, sustainable cities, and biodiversity conservation—making sustainability not just an ideal, but an economic necessity for India’s future. Read more

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.