CAGR Insights is a weekly newsletter full of insights from around the world of the web.

What we’re reading this week?

- How a Farmer’s son achieved financial stability starting from a salary of Rs. 5000: Read here

- How the Sensex Keeps Changing Over Time: Read here

- Why India’s struggling wool economy offers a cautionary tale for policy makers: Read here

Gold or Equity? The Smarter Way to Win Is Not Choosing Sides

We all saw a phenomenal run by gold recently while Indian equity markets are down from last 1.5 years. This would have made all of us question our asset allocation and would have tempted us to invest more in gold rather than equities. In today’s newsletter we address this confusion.

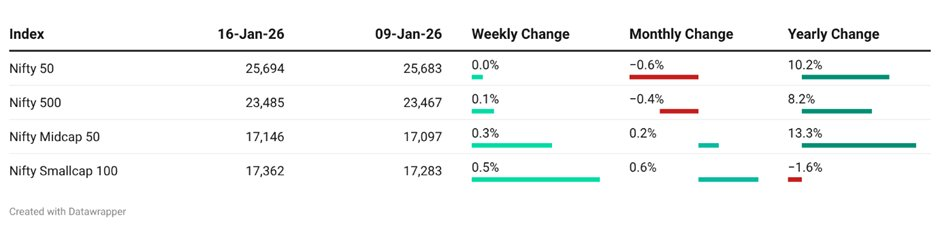

Returns

A common misstep among investors is directly comparing gold with equities to determine which asset class is outperforming at a given time. However, it’s crucial to recognize that gold and equities serve different roles in a portfolio. Rather than viewing them as competitors, they should be seen as complementary assets.

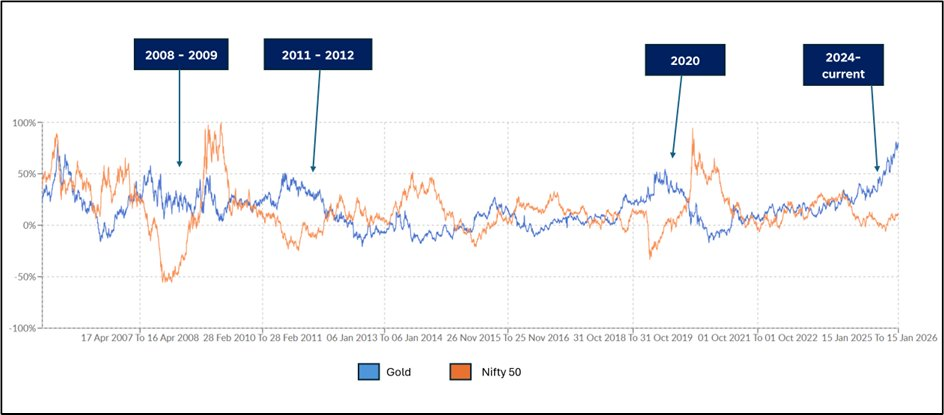

Gold often acts as a hedge during periods when equities underperform. For instance:

- 2007–2009: Amid the global financial crisis, equities plummeted while gold prices surged.

- 2011–2012: Equity markets faced stagnation, but gold continued its upward trajectory.

- 2020: During the COVID-19-induced market crash, gold prices rose sharply.

- 2024–Current: Equity markets experienced stagnation and drawdowns, whereas gold maintained its growth.

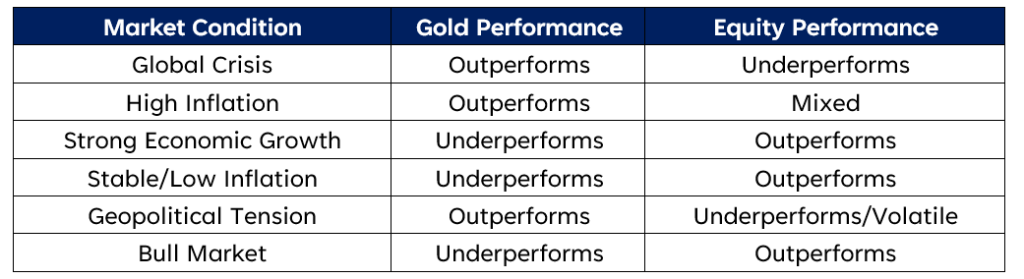

These instances highlight gold’s potential to provide stability during equity market downturns. Every time there is turmoil which threatens stability, money tends to move towards gold which is considered to be a safe store of value.

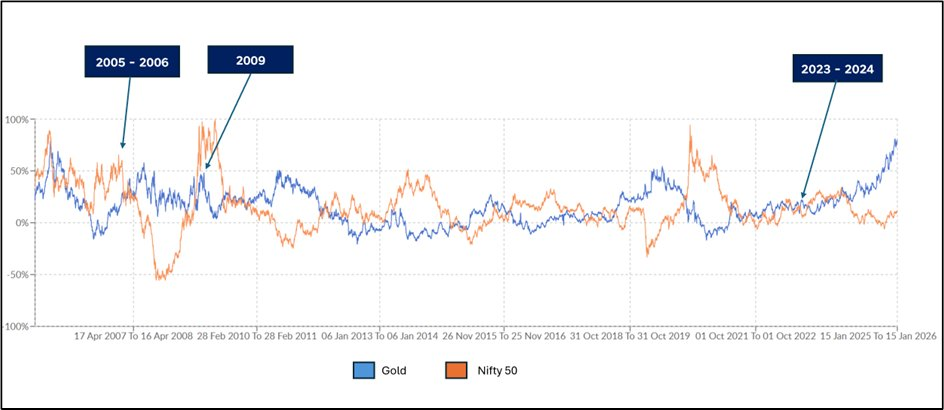

Because of the above pattern, it is commonly said that gold and equities move in opposite directions—but that’s not entirely accurate. There have been several periods when both gold and equities have delivered strong performance simultaneously.

- 2005: In 2005, India’s equities surged 43% on 8.4% GDP growth from manufacturing/services boom and FDI, while gold rose 20% amid global liquidity, China demand, and rupee stability.

- 2006: In 2006, India’s equities surged on sustained economic expansion, foreign investment inflows, and sector booms in real estate and IT despite mid-year volatility, while gold advanced amid ongoing Chinese commodity demand, loose global monetary conditions, and strong seasonal purchases.

- 2009: Post the financial crisis, equities rebounded, and gold continued its ascent.

- 2023-2024: Geo-Political uncertainty driving demand for Gold from Central Banks

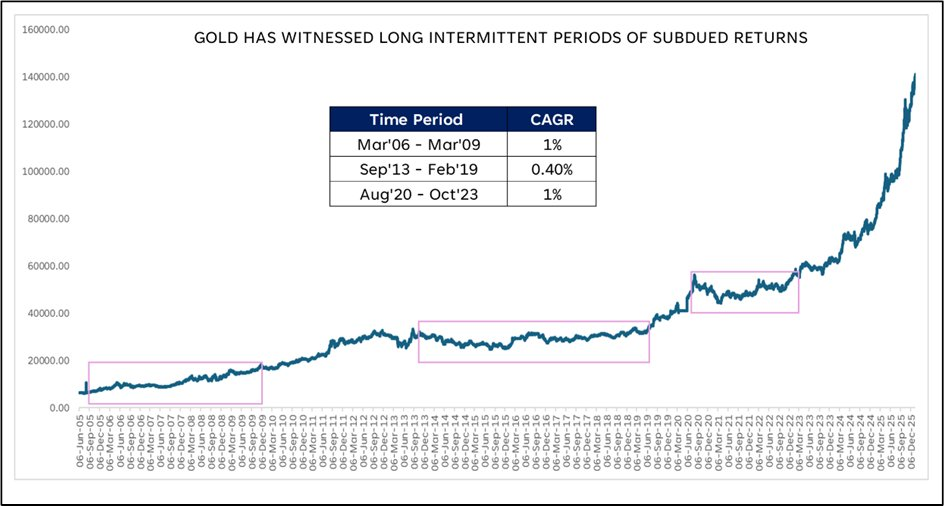

Is Gold always a positive trending asset class?

No. Just like any asset class; Gold has gone through periods when it has given negative returns to investors. Gold has also gone through long periods of stagnation.

But the bigger question today is to decide whether to invest in Gold or Equity.

Before we get to the narrowing of the answer, let us look at how gold and equity stack up against each other over the long term.

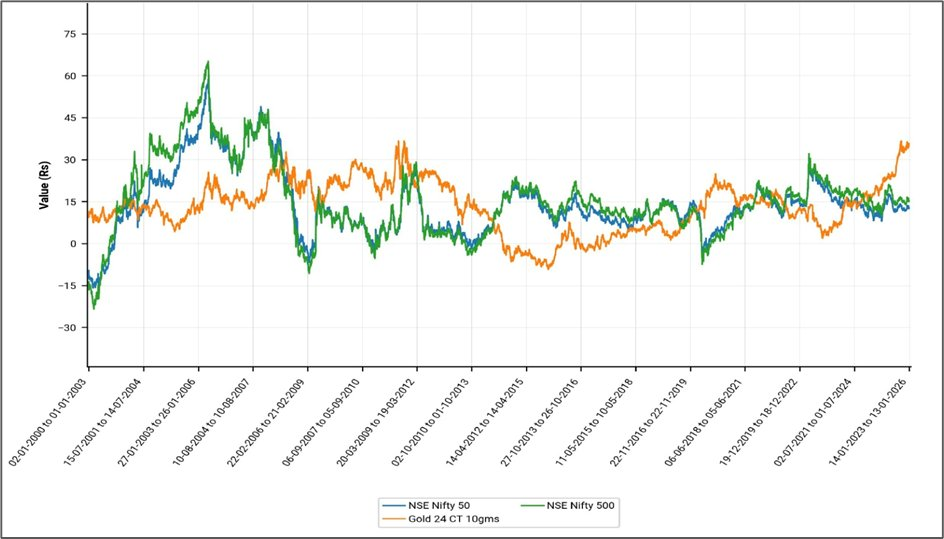

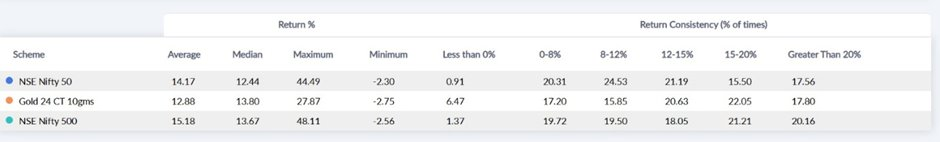

We looked at the 5-year rolling returns of 24ct Gold, Nifty 50 and NSE 500 since 2000.

The results are noticeable.

- Average 5-year rolling returns for Gold is slightly lower than that of Nifty 50 and NSE 500

- Gold has more instances of negative return than either of the indices. So yes, Gold has gone through a greater number of 5-year periods when it has delivered negative returns

- Both Gold and NSE 500 have given >15% return ~40% of the times

- Gold and equity have more periods of negative correlation than positive correlation. The below table summarises how gold and equity behave in different circumstances.

Any investment decision should ideally be driven by two aspects – How much you allocate and how much you pay.

Asset Allocation in Gold

We have always believed that a 10-15% of net worth allocation to Gold is an optimum one. This is because Gold is an asset class which has a single dynamic. Unlike equity, which is a combination of thousands of businesses, there is no diversification within Gold as an asset class.

Further, Gold prices are driven solely by demand and supply and there is no underlying business cashflow that defines gold as an asset class.

On the other hand, equity prices are also a function of demand and supply but equity as an asset class benefits from ownership in businesses. Its returns come from earnings growth, dividends, and valuation expansion, which makes it a wealth-creating asset over the long term. As economies grow and companies expand, equities tend to compound wealth significantly.

So Gold is a single product asset class with a single dynamic of price driver. Anything beyond 10-15% can serve as a concentration risk.

How much you pay?

How much return we make out of an investment is determined by at what point we invest and for how long are we willing to wait.

There is no strict science to calculate the right price point to enter. The leap of faith has to depend on data and a little bit of what you feel.

For example, to decide where to put your money today, you need to think that if Gold has given 2X returns in the last 12-18 months, can it double from here in the next 3 years. If the answer is yes, you would want to invest more.

Once we understand the long-term potential of an asset class, the best time to invest is when the asset class has been lying low and not garnering the maximum interest. The second-best time is to invest when the asset class has gained momentum, and you see further room on the upside.

Conclusion

Both equity and gold are long term asset classes, and any investment should be made keeping at least 5-7 years of time frame in mind.

For those who have a low allocation to Gold, build long term allocation through SIPs and STPs. For those who have adequate allocation, avoid building long term allocation. Any tactical call should be backed by strong data backed views.

Gold and equity are not rivals—they are complements. One should use equity to grow wealth and gold to protect purchasing power and manage risk across cycles.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.