CAGR Insights is a weekly newsletter full of insights from around the world of the web.

What we’re reading this week

- Here’s the secret to spending money with no regrets: Read here

- Why your salary alone does not decide your loan terms: Read here

- Deep Structural Reforms supporting India’s economic resilience: Read here

How GIFT City’s USD Mutual Funds Revolutionize NRI Portfolios

Priya Sharma, a savvy Mumbai-based marketing professional, has always invested with discipline—steadily building wealth through SIPs in mutual funds. With ambitions of funding her daughter’s US education and eventually settling abroad, she sensibly diversified into international funds of funds.

But her confidence is now fraying. RBI’s long-standing overseas investment cap has choked access to global funds, and each morning the weakening rupee tells a harsher story. A 12–15% return in India shrinks to single digits in dollar terms, quietly wiped out by a 4–5% annual currency depreciation.

Despite doing everything right, Priya feels shortchanged. Her savings aren’t failing—India’s currency is. And she’s left asking why disciplined investing still can’t protect her global goals.

Priya then discovers GIFT City—more than a location, a financial lifeline built for investors like her. Launched in 2015 as India’s first International Financial Services Centre (IFSC), it allows mutual fund investors to access global markets without the burden of stock picking.

With investments denominated in foreign currency, gains are insulated from rupee depreciation offering seamless global exposure. It’s a bold policy vision—designed to help investors earn global returns without their wealth being dragged down by INR volatility.

Priya leans in—this isn’t a distant promise, it’s already live. GIFT City offers foreign currency-denominated mutual funds with a simple, powerful advantage: invest in foreign currency, redeem in foreign currency.

She can put dollars to work from her Indian salary, see her NAVs compound in USD, and eventually withdraw in dollars for her life overseas— only one time conversion at the start of investing, no rupee erosion, no depreciation drags at all.

Why does this matter now?

The rupee’s decline isn’t slowing. Trade deficits, oil dependence, and shifting global capital flows continue to weigh on INR. What looks like a 10% gain in rupee terms often shrinks to just 5–6% when measured in dollars.

For investors like Priya with global goals, this gap is costly. GIFT City changes the equation.

Real-World Use Cases That Resonate

Use Case 1: Funding Foreign Education.

- Priya’s daughter plans a US master’s degree—about $50,000 per year in tuition. With traditional India-based investments, Priya would redeem in rupees and convert to dollars later, risking a 15–20% cost increase over four years due to rupee depreciation.

- GIFT City’s USD-denominated mutual funds offer a smarter route. Priya invests and redeems directly in dollars—no forex conversion loss, no TDS—keeping her education corpus aligned with actual expenses, subject to annual LRS limits.

Use Case 2: Global Diversification

- Diversification is the real game-changer. Priya no longer wants an India-only portfolio. Through GIFT City, she can access outbound funds investing across global markets—US, China, Europe and more—all denominated in USD.

- The result? Smarter risk spreading. US tech can cushion Indian market swings, and global exposure brings balance to her portfolio. With IFSCA’s single-window approvals, onboarding is simple and seamless—global diversification without the usual friction.

Use Case 3: Outbound Investing:

- To fund her overseas ambitions, Priya makes her strongest move yet—outbound investing through GIFT City. Via USD-denominated mutual funds and AIFs, she gains direct exposure to global leaders like Apple, Tesla, Nasdaq indices, and Chinese equities from day one.

- This isn’t just diversification, it’s borderless growth. Her investments are aligned with her future expenses, insulated from INR depreciation, and purpose-built for Indians with global goals.

Priya’s story reflects the reality of thousands of Indian investors today. If your goals are global, your portfolio should be too.

While this sounds exciting—and it is—it’s important to note that GIFT City investing makes the most sense beyond a certain net worth. Here’s why:

- LRS-based funding: Investments are routed through the Liberalised Remittance Scheme, which means additional bank-level documentation and compliance, including Form A2.

- Tax reporting complexity: Since these investments are USD-denominated, they require additional disclosures in your income tax returns, adding to compliance effort.

- DIY investor caution: For self-directed investors, it’s critical to understand the underlying global exposure of the mutual fund—geography, sectors, currency, and concentration—before investing.

In short, GIFT City is a powerful tool, but it’s best used thoughtfully, with the right scale and clarity.

PSA: Investing in a country ≠ just market risk

A lot of investors miss this: when you invest in another country, you’re not only betting on its companies, but you’re also taking on that country’s currency and macro-economic risk.

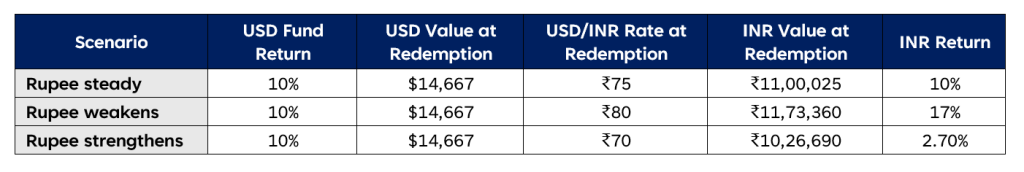

Suppose Priya invests ₹10 lakh in a US-focused mutual fund when 1 USD = ₹75. She buys $13,333 worth of US stocks.

Insights:

- Even though the US fund gained the same 10% in all cases, INR returns vary widely depending on currency movement.

- A weakening rupee boosts returns for Priya, while a strengthening rupee erodes them.

- This is why investing abroad without considering currency risk can be misleading—your INR performance may look very different from your USD performance.

Priya’s journey highlights a crucial truth: disciplined investing in India alone may no longer be enough for global goals. GIFT City’s USD-denominated mutual funds offer a practical, efficient way to align investments with overseas aspirations—providing currency protection, global diversification, and seamless access to international markets. For investors seeking to secure education costs, build borderless portfolios, or hedge against INR depreciation, the opportunity is real and timely.

As a trusted mutual fund distributor, we also offer access to GIFT City products, helping our clients invest confidently in global opportunities. Reach out to us to explore how you can give your portfolio a truly international edge.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.