CAGR Insights is a weekly newsletter full of insights from around the world of the web.

What we are reading this week

- There’s Always Room for Quality: Read here

- Gold Price Pattern Shows Where the Market May Go Next: Read here

- Critical minerals are ‘strategic choke-points’ in energy transition: Read here

From Red Screens to Lifetime Riches: Raj’s Untold Saga of Mastering Long-Term Investing

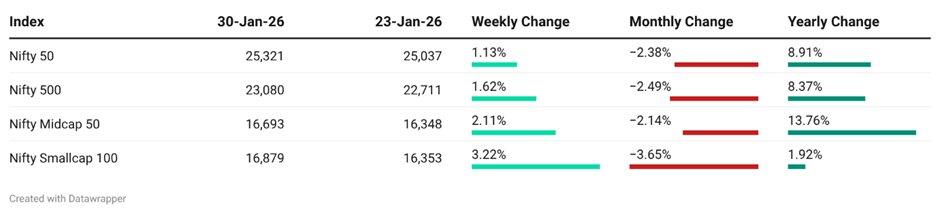

We hear you—loud and clear. Portfolios flashing red. Returns not exciting investors for nearly two years. The Nifty’s grind through 2024–2026, Fed rate hikes, Trump’s whims and fancies, and relatively slower corporate growth have tested everyone’s patience.

“Two years down… we came looking at phenomenal returns of Indian markets in 2023-24, when will we experience the same?”

These are the calls filling our days.

One such call came from a client who joined us in June 2024. After months of investing, his portfolio showed no meaningful returns. Anxiety had set in, and his faith in equities was wavering. Instead of offering reassurance through words alone, we showed him something more powerful—the journey of one of our long-standing clients, Raj Patel (name changed), a 48-year-old Mumbai-based investor with over 13 years in the market (even before he became our client).

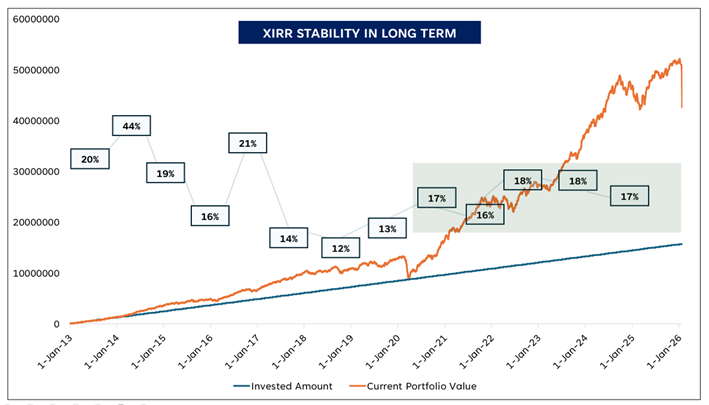

We began with Raj’s early years – he was investing Rs. 1 lac per month in a portfolio of equity mutual funds since 2013. While his investments increased over time, we have assumed that he continued investing Rs. 1 lac since then.

The below chart showcases Raj’s journey of investing Rs. 1lac per month in a portfolio of four funds (Rs. 25K each). Further, we have assumed that the portfolio remains unchanged for the sake of simplicity. The four funds chosen are –

- HDFC Midcap Fund Regular Growth

- ICICI Equity and Debt Fund

- UTI Index Fund

- Franklin Flexi Cap Fund

Raj’s journey offers three very important learnings.

LEARNING 1

The first few years of investing represents a story which can look very different from reality – both on the upside and the downside.

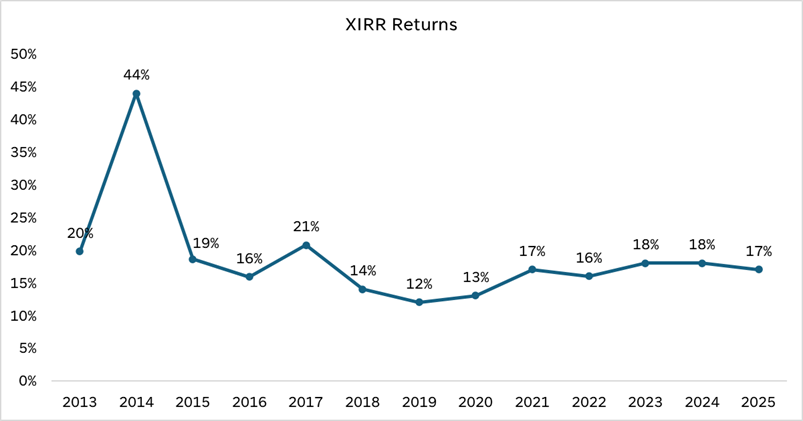

For Raj, the first few years looked exceptional. 20% XIRR in the first year and 44% in the following year (driven by BJP led rally in 2014). The return then fell to 16% XIRR in the fourth year and let’s be honest – Raj was disappointed because by now he had gotten used to seeing >20% returns at any point in time.

This is when he came to us. And we helped him set more realistic expectations.

After seven years of consistent investing, Raj’s portfolio stabilized and began delivering a healthy XIRR of 16–18%. Just for context, this means that his money is likely to double every 5 years.

In the current scheme of things, a lot of first-time investors started investing in mutual funds after witnessing the bull market returns that their friends, relatives and colleagues made from 2021-2024. For anyone who has been investing for less than 3 years, the returns look anything but exciting.

But what is important to understand, is that the combined effect of time, compounding, and staying invested smoothens volatility.

Imagine if Raj had started his SIP in March 2018, his XIRR journey would have looked like below.

LEARNING 2

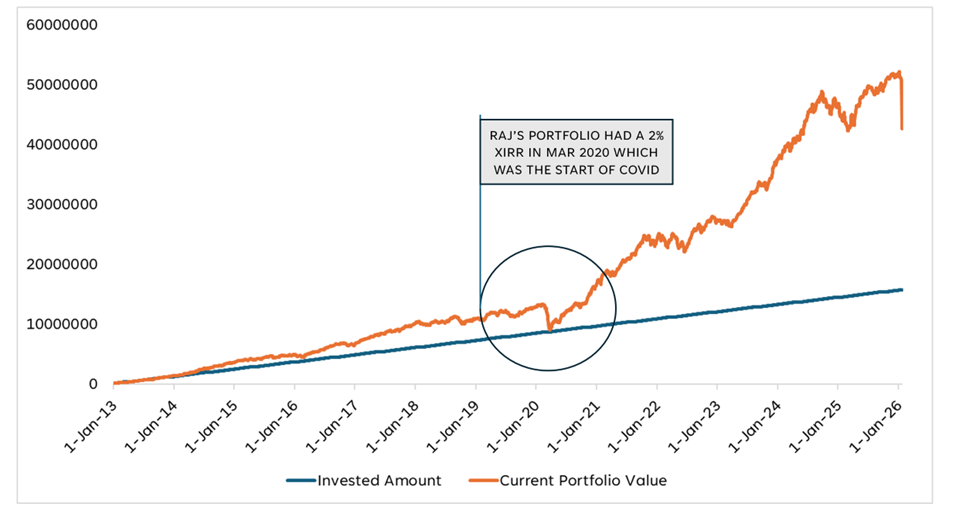

We together with Raj witnessed a completely different chapter in March 2020.

Nifty 50 fell by 35% from its last high and Raj’s portfolio XIRR dropped to just 2%. Imagine – Even after investing for 7 years, Raj witnessed a massive erosion of all his past gains.

Can this happen to you?

Absolutely. Black swan events cannot be predicted and the outcome could look very depressing even as a long-term investor. All equity investors should therefore know that while these instances will be rare and few, they can happen.

LEARNING 3

Raj did get uneasy in March 2020. But he had also seen 2008 and he somewhat understood black swan events.

Moreover, Raj did not need to redeem. His equity investments were aligned with long-term goals, and his near-term cash needs were already planned elsewhere. He was comfortable to stay put, let his SIPs run.

But what if Raj had a planned use of his investments in March – April 2020. What if his son was going into college and he had planned to use his mutual fund investments to fund the cost?

He would have had to exit at a 2% average annualized return – an extremely unexpected outcome and something nobody deserves.

Ideally, if Raj had a planned utilization of funds in 2020, he should have started shifting his corpus to safer avenues starting 2017/2018. Such a shift to a mix of Debt, Arbitrage, Hybrid funds would have ensured that he books gains at much higher returns and subsequently protects his capital.

This is something that most investors do not think enough about. Especially in the middle of a bull market, one tends to put everything in equity investments. Even funds which they know they will need in the next 2-3 years. Ignoring the possibility of a big market drawdown is a common mistake and one which we under-estimate more than we should.

The key takeaway is that markets are rewarding. But for it to be rewarding for you, it has to be coupled with patience, endurance and meticulous planning.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.