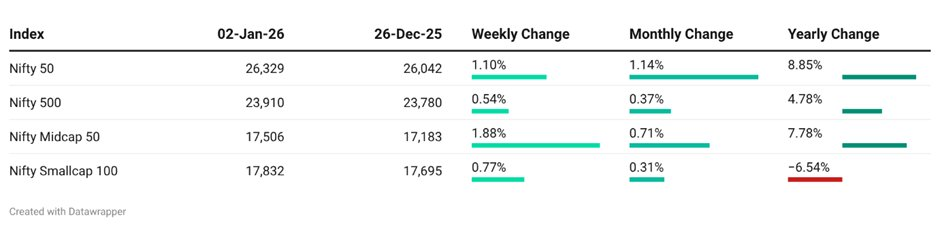

CAGR Insights is a weekly newsletter full of insights from around the world of the web.

Looking Beyond Mutual Funds? Here’s Why SIFs Might Make Sense

Specialised Investment Funds (SIFs) are SEBI-regulated investment options that give fund managers more flexibility than regular mutual funds. Unlike traditional mutual funds that predominantly follow a stock only approach, SIFs employ an active allocation framework and can use tools like derivatives to manage risks.

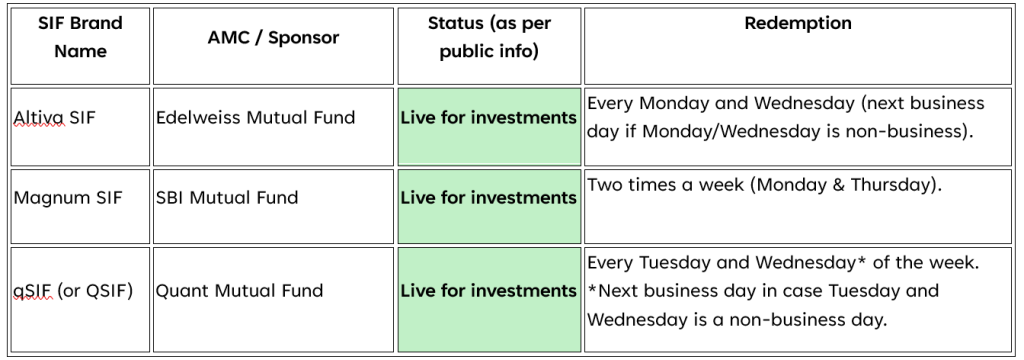

SIFs are being launched by Mutual Fund AMCs subject to regulations laid down by SEBI. Eligible AMCs are launching the SIFs under a different brand to differentiate the category. Minimum investment size for an SIF is Rs. 10 lakhs.

Why were SIFs launched?

Before SIFs were launched, mutual funds were the only investment avenue for the masses to invest in equity market. PMS entities have a minimum tranche of Rs. 50L and AIFs have a minimum tranche of Rs. 1Cr.

This rendered the masses incapable of being able to invest smaller chunks of money and at the same time get exposure to nuanced strategies which help them ride both cycles of the market.

SIFs because of their ability to use derivatives, claim to fill this gap. Using select derivative strategies, SIFs aim to benefit from both the upside and the downside of the market. They are in that sense an alternative to a certain category of Cat III AIF, more popularly known as Long – Short AIFs.

Therefore, SIFs were launched to enable mass investors access flexible strategies—like long-short positions and derivatives—while enjoying mutual fund taxation, aiming for better risk-adjusted returns across different market conditions.

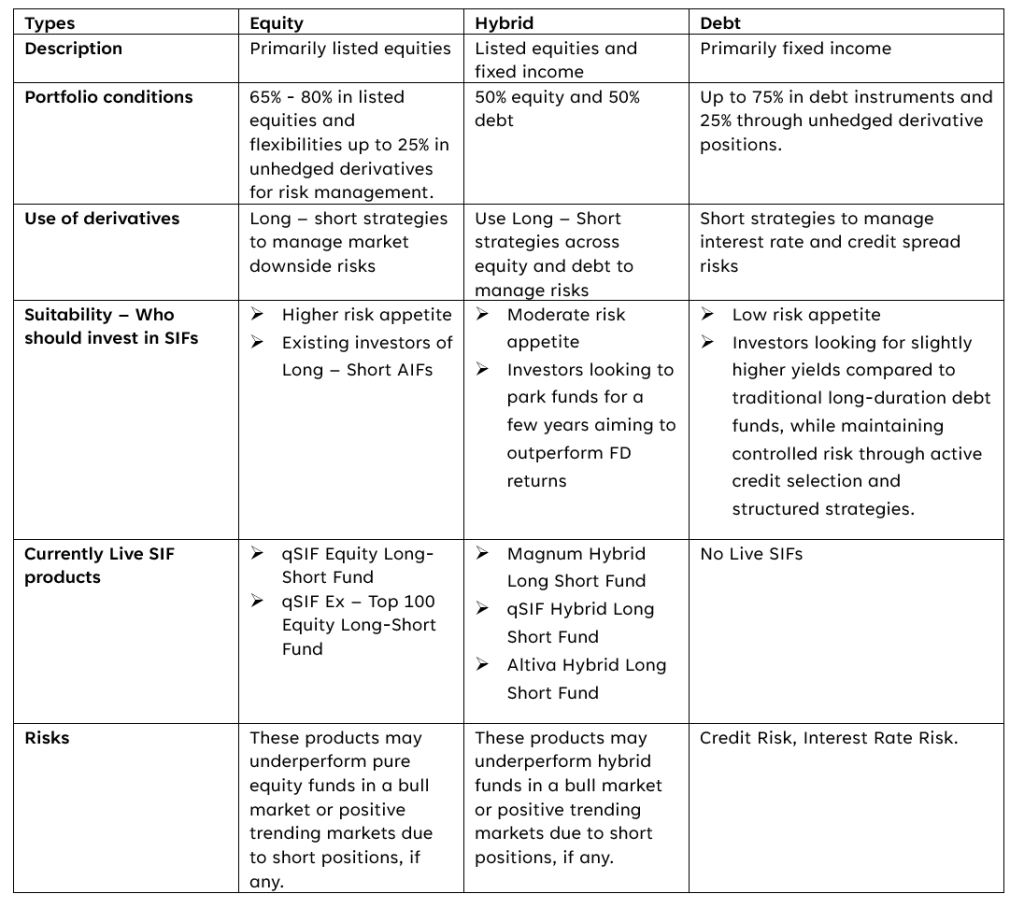

What are the different types of SIFs?

Considerations for Investing in SIF’s

- Minimum Investment: 10 lakhs

- Risk Appetite: Investors should understand that these funds use advanced strategies like long-short positions and tactical allocation, which may carry higher risks than regular mutual funds.

- Dependence on fund manager expertise and execution capabilities.

- Use of leverage, derivatives, and short positions introduces strategy-specific risks, including potential for amplified losses and increased volatility.

- Aim to seek portfolio diversification into less conventional asset classes and strategies.

- Are prepared for longer investment horizons aligned with redemption terms.

Before investing, investors should review their financial goals, risk appetite, and liquidity needs, and consider consulting a SEBI-registered financial advisor.

Ticket Size: Minimum investment is ₹10 lakh aggregate per investor across all SIF strategies in one AMC. SIPs are allowed if cumulative meets this threshold.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.