CAGR Insights is a weekly newsletter full of insights from around the world of the web.

Here’s what we are reading this weekend:

- How the ‘No Buy 2026’ trend could help you get your budget on track this year: Is this the year of cutting back? Read here

- Is a US market correction coming? Read here

- Budget 2026: Why do India’s farms suddenly matter? Read here

———————————————————————————————–

CHINA: THE EMERGING TECH HEGEMON

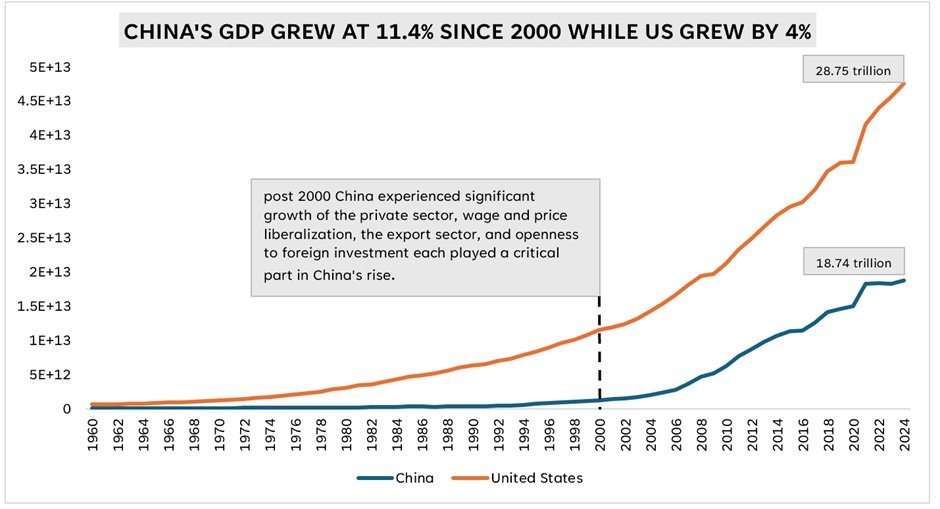

In this edition, we turn our spotlight to China. While global markets remain fixated elsewhere, China is quietly building the future through tech-led manufacturing, robotics, and AI—and with valuations still depressed, this growth story may be one of the most interesting opportunities for investors today.

China is the second largest economy in the world after United States. It’s GDP in 2024 stood at 18.49 trillion (US dollars) which is 4 times the GDP of the 3rd largest economy in the world – Japan. China’s growth story is not just inspiring but also the one we can learn from, their reforms which are characterised by long term visualization and rapid economic growth.

In its 15th five-year plan held in October 2025, the Chinese government highlighted their plans to stay resilient in a volatile world with technological self-sufficiency, and innovation remaining their primary focus.

During the new FYP period (2026-2030), China aims to seek breakthroughs in areas such as advanced tech driven manufacturing and develop a lead in AI with the aim to reduce its dependence on foreign countries.

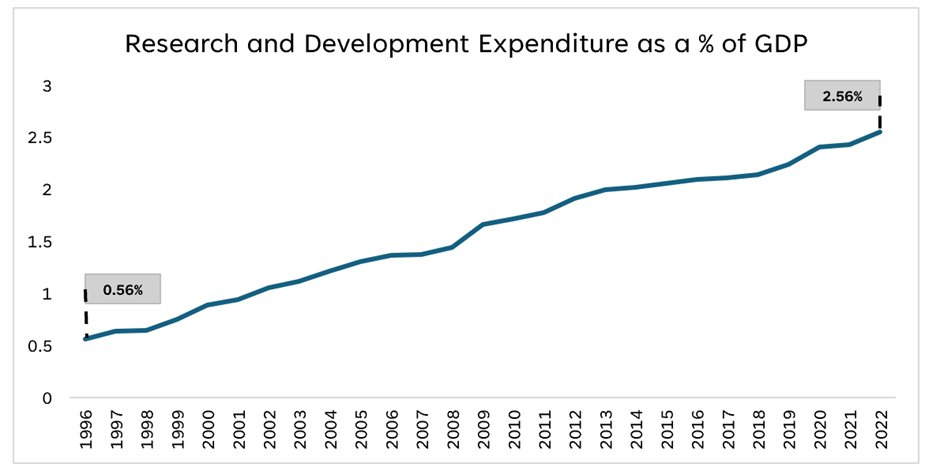

To achieve its vision, China has been focusing on R&D as a key driver for achieving its goals

China’s government R&D spending is set to surpass that of the US in 2026, with an 8.3% budget hike focused on basic science.

How does China compare against US on the technological landscape?

Tech Driven Manufacturing

China has been expanding into emerging sectors like batteries, electric vehicles (EVs) and autonomous vehicles.

Developing autonomous-driving capability requires a large installed base of modern vehicles that can run advanced driver-assistance systems. China has built a base on a scale no other country can match, largely because of its overcapacity.

More than 60% of the EVs sold in China now come equipped with driver-assistance features that support partial automation, often at no additional cost for consumers.

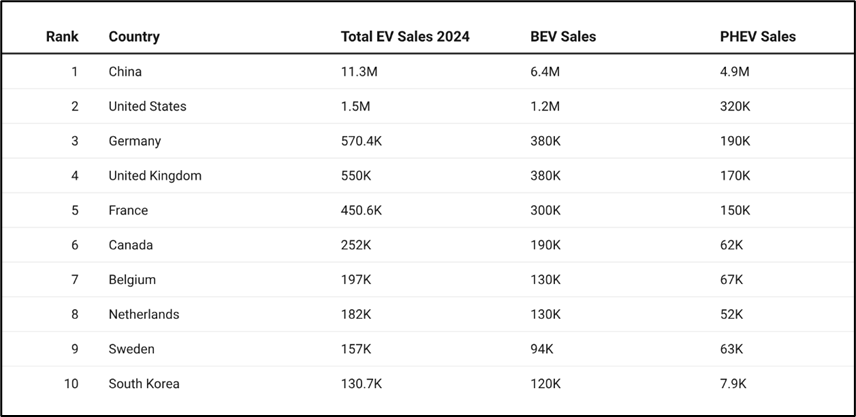

And China’s scale in the whole EV space provides the necessary base for driving automation. The total EV sales in 2024 reached 16.9 million and China dominates this market accounting for over 67% of the total world sales.

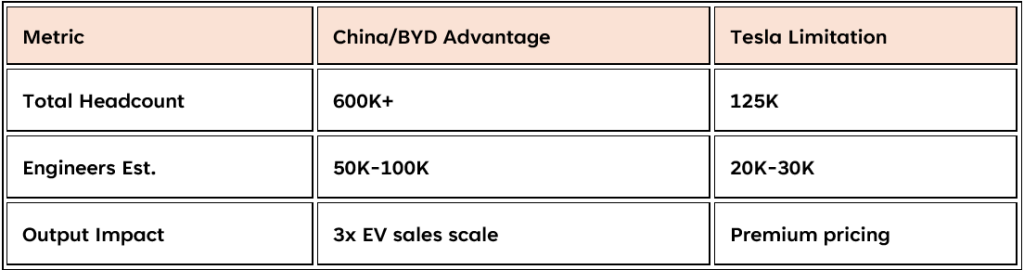

China’s massive scale in EV is supplemented by the huge workforce behind it.

BYD’s massive workforce scale—600K-700K total employees versus Tesla’s 125K—gives China a decisive edge in rapidly deploying AI across physical ecosystems like EVs, drones, and factories.

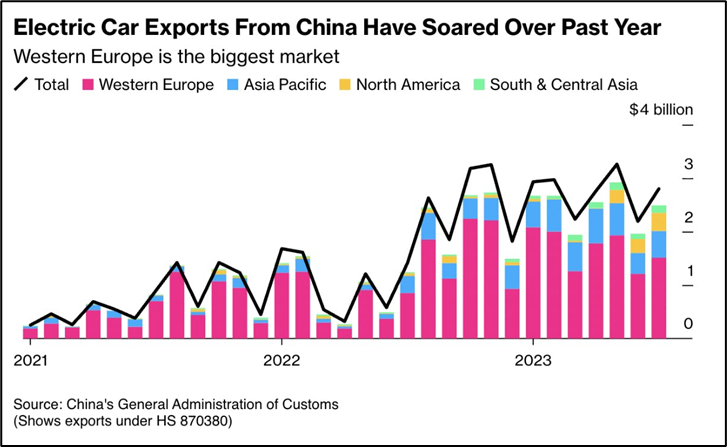

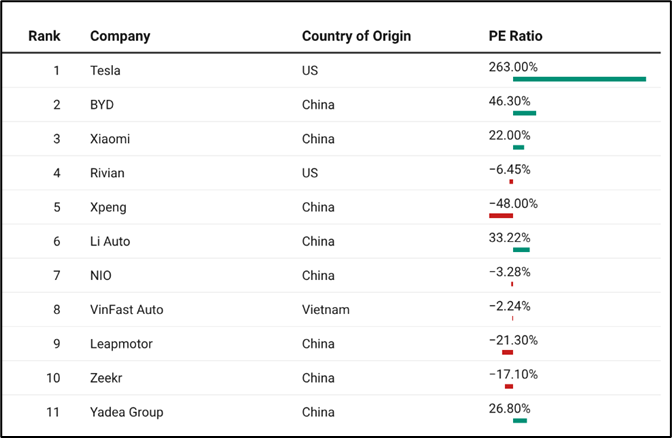

China’s dominance in the EV space is not just domestic. It has also been able to garner a significant share globally, as evidenced by the rising number of exports. 8 out of the top 11 EV companies’ origin from China and are less expensive compared to their US counterparts.

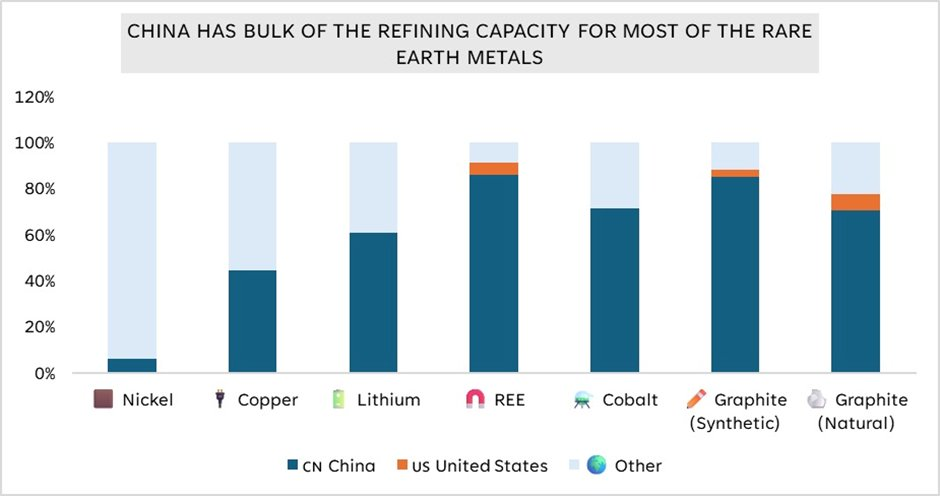

What makes China interesting at this point is the fact that EV supremacy will be faster for countries which have access to rare earth materials like cobalt, lithium, graphite etc.

If we dig deeper and look where do these rare earth materials reside, we realize that China is way ahead of the entire world.

China is projected to have the largest share (60%) of global refined critical mineral supply by 2030.

Nickel is the only outlier in the rare earth minerals where China lags Indonesia (71%). We feel that China’s supremacy in rare earth materials places it at a very advantageous position to leverage the EV wave over the next decade.

How has the equity market perceived the EV space so far?

Despite China’s dominance in the EV ecosystem, this leadership is yet to translate into commensurate equity market returns.

In fact, leading Chinese EV players are currently trading at significantly lower valuations compared to their global peers, despite stronger scale, integration, and cost advantages.

Robotics

What was once seen as a weakness — chronic manufacturing overcapacity — has effectively become China’s strategic strength. Overcapacity is what helped China mass deploy autonomous driving capability on modern vehicles.

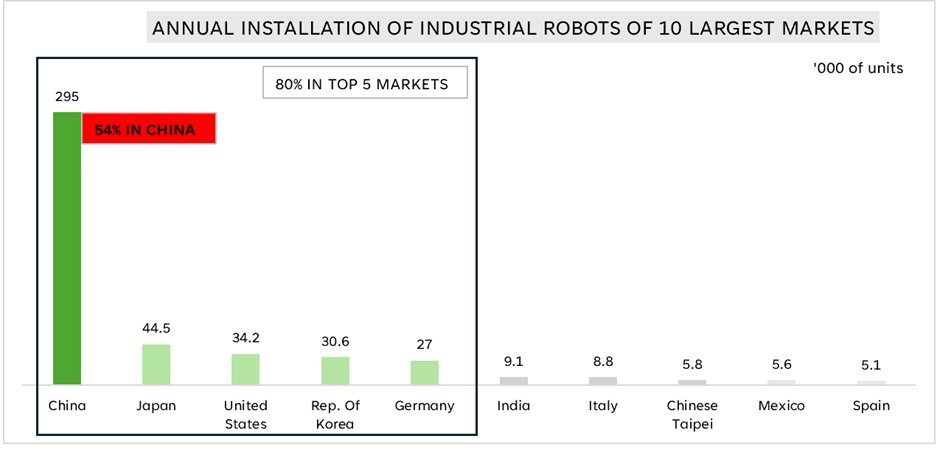

The same dynamic is now playing out in robotics. Buoyed by generous local subsidies and a strong national industrial policy push, robot manufacturing in China has expanded rapidly in recent years. Chinese factories now install around 280,000 industrial robots annually — roughly half of the global total — with nearly 60% of those units supplied by domestic manufacturers offering significantly cheaper machines.

According to the International Federation of Robotics, China accounted for 54% of all industrial robot installations in 2024. And that percentage is expected to grow in coming years.

Artificial Intelligence

Artificial Intelligence is the next big technological advancement that is taking the world by storm. And this is one space which are witnessing the emergence of two big hegemons – US and China.

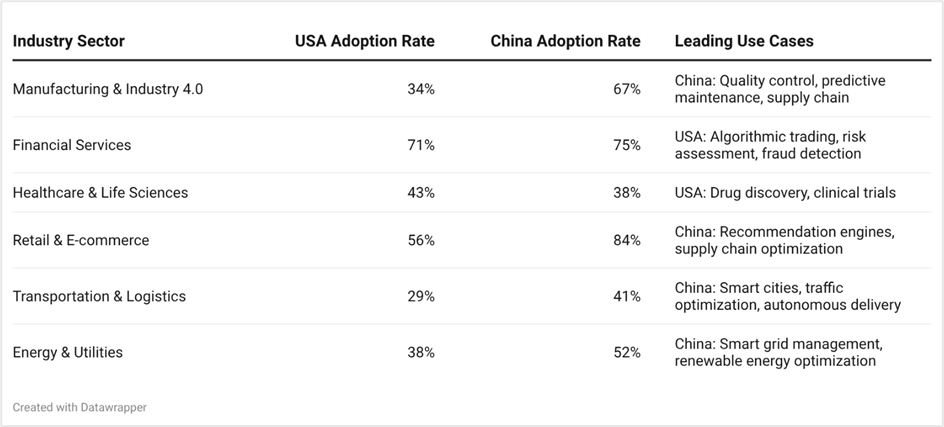

The USA-China AI competition is reshaping global technology landscapes, driving unprecedented innovation while creating new geopolitical tensions. Rather than a winner-take-all scenario, we’re likely heading toward a bifurcated AI ecosystem where both superpowers excel in different domains.

China is investing heavily in creating home – grown AI talent. There is considerable focus on rapid skill development in the AI space. However, better opportunities in the US have been causing some level of brain drain from China to the US. It will be interesting to observe how China addresses this issue in the years to come.

Further, China is much ahead in testing and adopting some of the AI technologies on their domestic industries. This should give China the benefit of having a faster and bigger feedback loop to re-iterate and evolve with speed.

Which country captures the larger AI market-share will depend on who is able to create a more sustainable eco-system. And this eco-system will be driven by two key aspects:

- Adequate electricity which can fuel the needs of AI systems

- Supporting infrastructure that allows these systems to operate safely, such as data centres

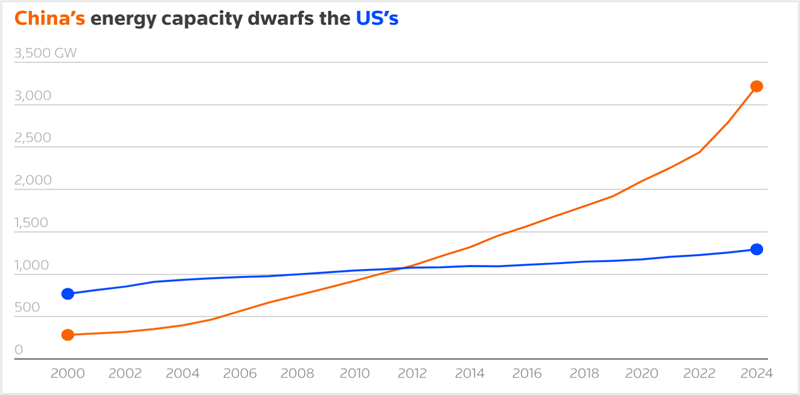

Not only does US have a much older power grid, but it is also far behind China in terms of electricity generation capacity. Just for context, China added 427GW of new power capacity in 2024, which is more than one-third of the entire US grid and more than half of all global electricity growth.

Perhaps even more important, China added 304GW of solar generation capacity in the first 10 months of 2025 – greater than the entire installed solar capacity in the US of about 259GW.

Not to mention, Industrial electricity bills are also on average 30% cheaper in China than in the United States.

China is investing huge sums to build new capacity in order to keep up with rising electricity demand. China aims to establish a new grid system to support a west-to-east power transmission program exceeding 420 gigawatts by 2030, according to the guidance issued by the National Energy Administration and the National Development and Reform Commission.

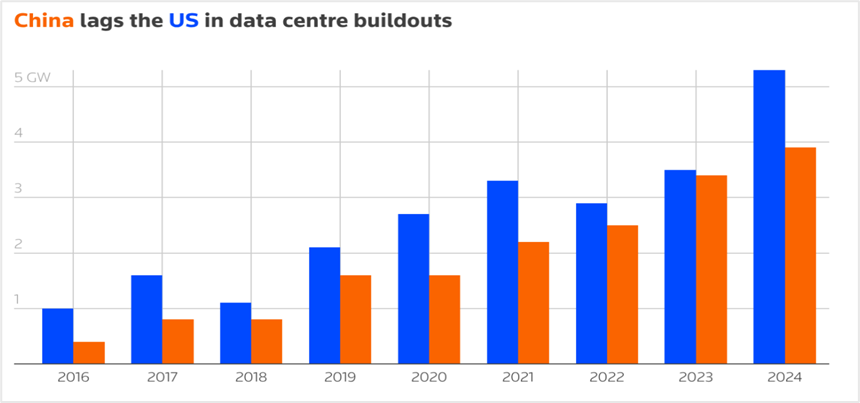

While China seems to have a much better hold on the electricity front, The People’s Republic has lagged the United States in building new data centres and bringing more computing power online. This has resulted in US Chip Control continuing to remain a formidable constraint. Bernstein’s research outfit’s analysts estimate Chinese firms will spend just $147 billion on AI capital expenditures in 2027. That’s less than Amazon’s expected total capex that year, per Visible Alpha forecasts.

As AI moves from our screens into the physical world, the question is no longer whose models hit technical benchmarks, but who can build and sustain an ecosystem that embeds AI into everyday products and services. Viewed through this lens, China enjoys a distinct advantage that does not show up in standard measures of AI performance. Counterintuitively, China’s strength stems from what economists have long treated as one of its deepest structural weaknesses: overcapacity.

Conclusion

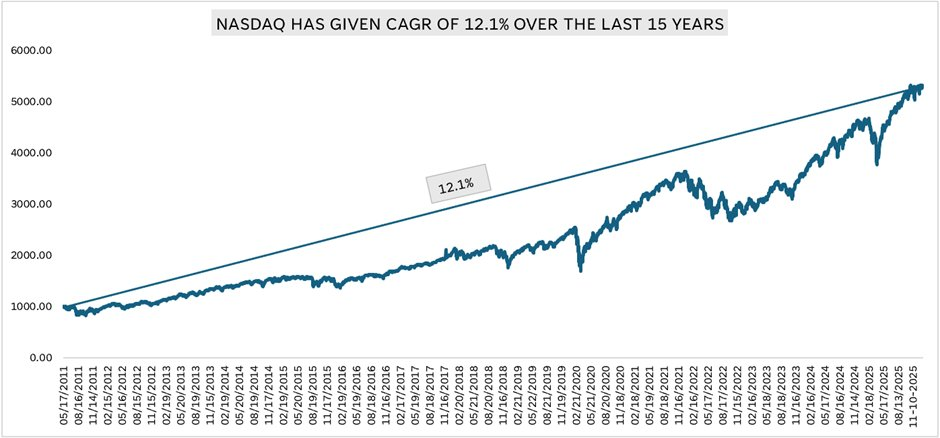

China and the US are the two hegemonic forces shaping the global economy, yet the market outcomes for both could not be more different.

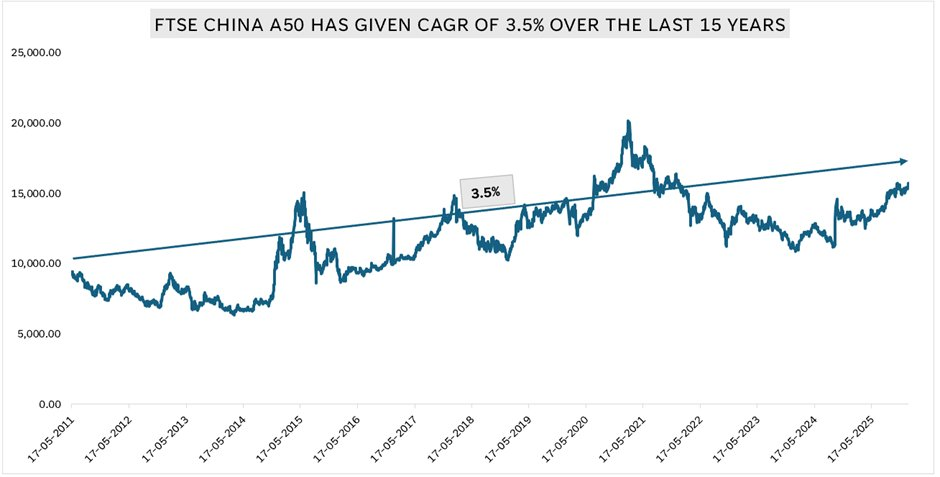

While China has spent the last 15–20 years aggressively scaling its technology-driven manufacturing base and expanding its economic footprint, its capital markets have yet to fully reward this growth in the way US markets have.

Over this period, China has built world-class capabilities across EVs, batteries, solar, electronics, and now robotics, even as its equity valuations have remained compressed.

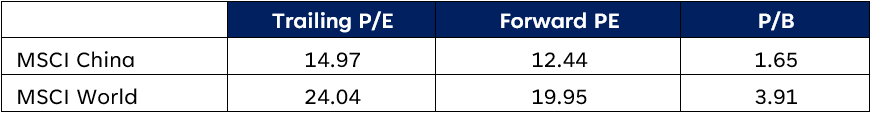

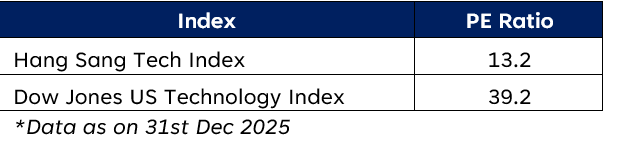

Chinese markets remain undervalued at ~13x forward P/E (40% below S&P 500).

The tech sector in China particularly remains undervalued compared to US.

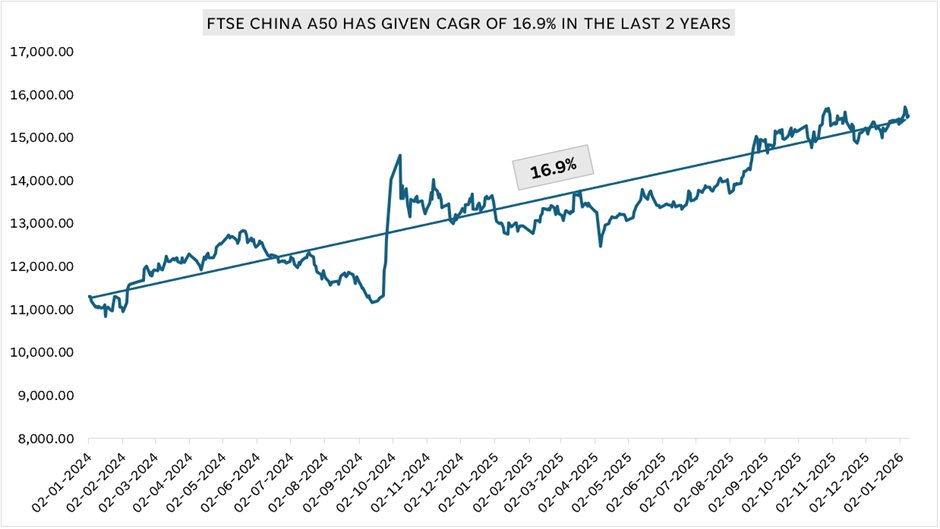

However, if we look at the last two-year trajectory of the Chinese markets, we can see that there seems to be a roaring come back. Perhaps, the initiatives are now paying off as investors are returning to Chinese markets.

As we begin to see early signs of market uptick, we believe this could mark the start of a more sustained re-rating cycle in Chinese markets, especially given the strategic positioning of its industries and the relatively low valuation multiples at which many Chinese stocks continue to trade.

This could very well be the start of momentum in the Chinese markets!

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.