CAGR Insights is a weekly newsletter full of insights from around the world of the web.

Chart Ki Baat

Gyaan Ki Baat

The Cost of Waiting to Invest

Many of us spend years “researching” instead of investing, waiting for the perfect market moment. The truth is, no one can time the market—not professionals, not analysts, not YouTube experts. While you wait for certainty, time quietly works against you.

Consider Investor A, who starts a modest SIP today, and Investor B, who waits five years for the “right time.” Both invest the same monthly amount, but Investor A ends up significantly ahead simply because they started earlier. Waiting may feel safe, but it’s a silent drain on wealth.

The solution is simple: prioritize starting over perfect timing. Choose a diversified fund, set up an SIP you can sustain, and automate it. Phase in lumps sums if needed. Check your portfolio periodically, not daily. In investing, the biggest risk isn’t a crash—it’s not starting at all.

Personal Finance

- What is Basic Salary under new code on wages for pension, EPF, and gratuity calculation? The statutory definition of Wages under the Code on Wages, 2019, mandates that the combined total of Basic Pay, Dearness Allowance (DA), and Retaining Allowance must constitute at least 50% of an employee’s total remuneration (CTC). Read here

- Lost track of old deposits or shares? Govt, RBI to launch one-stop portal: The integrated portal would make it substantially easier for citizens to locate their unclaimed funds and convenience, transparency and trust. Read here

- From 20s to retirement: How a strong credit score shapes your financial life: A strong credit score impacts financial opportunities at every stage of adult life enhancing loan approvals, lower interest rates, credit card benefits, and long-term financial stability from 25 to 60. Read here

Investing

- Is This How the AI Bubble Pops? Tech’s new MBS? SPV-funded data centres look safe—until one assumption breaks. The hidden risk no one’s talking about is here. Read here

- A Simple Look at How Different Assets Perform Over Time: Asset performance changes wildly every year, proving why smart diversification wins long term—see which assets quietly dominated the decade. Read here

Economy & Sector

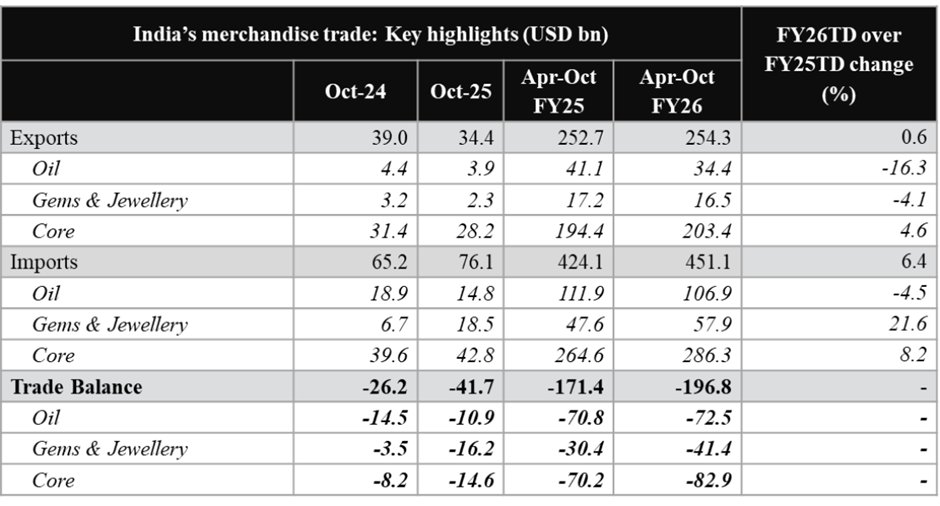

- Oct-25 Trade Deficit: Widens to a record high: India’s merchandise trade deficit widened to a record high of USD 41.7 bn in Oct-25 from USD 32.2 bn in Sep-25. While exports registered a mild sequential contraction, it was the steep jump in imports (especially gold) in the month that drove the trade deficit higher. Read here

- IMF gives India a ‘C’ on its GDP and other national accounts data, the second-lowest grade: The IMF noted that India’s national accounts and inflation data do not adequately capture key aspects such as the informal sector and people’s spending patterns. Read here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.