CAGR Insights is a weekly newsletter full of insights from around the world of the web.

Chart Ki Baat

Gyaan Ki Baat

When Even the Rules Bow Out

In investing, we’re often guided by time-tested principles: maintain a balance in asset classes, diversify, and lean away from impulse. Yet, there are rare occasions when these “rules” must be questioned. A 66-year-old investor, comfortably supported by pension and rental income (even funding two holidays a year), raised a bold question: why hold any debt if income covers all expenses? His entire portfolio is in equity mutual funds and direct equity.

This raises a profound truth: financial rules are not commandments—they are guides. The measure of a rule’s validity is its alignment with your personal context. If your income flows are stable and predictable, and your lifestyle isn’t threatened by equity’s swings, perhaps you can bend the rule of maintaining a debt cushion.

But this is precisely why such decisions demand introspection, not defiance. When you step into uncharted territory, clarity becomes your best friend. Ask yourself: Are your future costs covered? How will volatility affect your peace of mind? Do you have a fallback buffer if equity markets falter? When rules don’t apply, discipline must step in.

In essence: A rule is only as good as the wisdom behind bending it. If your financial fundamentals are strong, and purpose and prudence lead the way, then breaking a rule isn’t foolish—it’s strategic. But never break them out of arrogance—only with clarity and intent.

Personal Finance

- I built a house on inherited land; how will I be taxed if I sell it now? He inherited a 2016-purchased plot, built a home, and now lives there. As he considers selling, he wonders how capital gains will apply—and the answer isn’t as simple as it seems. Read here

- Rs 3,000 SIP Vs Rs 3 Lakh Lump Sum: Which One Is Better? It is important to assess your financial objectives, current circumstances and risk appetite before selecting investment instruments. Read here

- Why serious illnesses demand more than a standard health policy? Regular health insurance pays hospital bills but can’t replace income during a major illness. Critical illness cover offers a crucial lump sum—a safety nets most people recognise only when it’s almost too late. Read here

Investing

- The Ideal Level of Wealth: The idea of an “ideal level of wealth” is questioned, revealing surprising numbers behind the cost of a good life—and insights that might change how you think about money forever. Read here

- Understanding the Link Between Market Growth and Money Supply: Markets look high but are liquidity-driven, and a slowdown could cool the momentum. Big crashes seem unlikely—unless a shock hits. But one key ratio could change everything— to know why. Read here

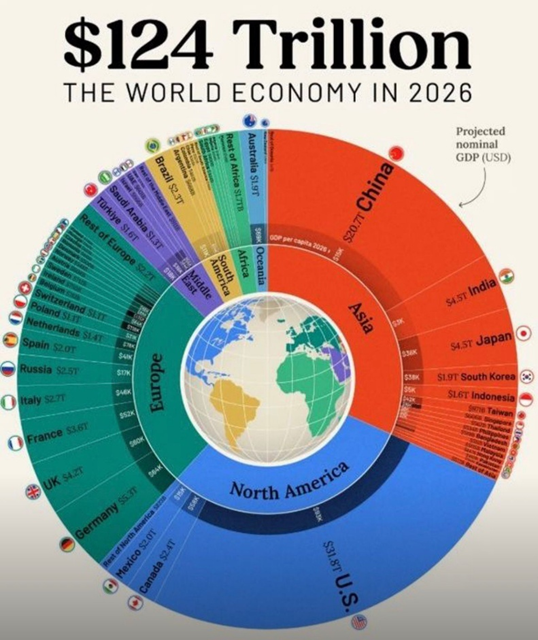

Economy & Sector

- India’s $10 trillion destiny will be decided by 4 Ds: India is poised for a historic economic leap, projected to become the world’s third-largest economy by 2040. This ascent will be driven by four key forces: Development, Diversification, Digitalisation, and Decarbonisation, shaping a resilient and future-ready nation. These pillars will guide India’s transformation towards becoming a developed economy. Read here

- Four charts that show how Bihar fared on major economic indicators: The vote counting for the Bihar Assembly elections points towards a significant lead for the National Democratic Alliance (NDA). Here’s a quick look at how the state has fared on key economic indicators. Read here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.