CAGR Insights is a weekly newsletter full of insights from around the world of the web.

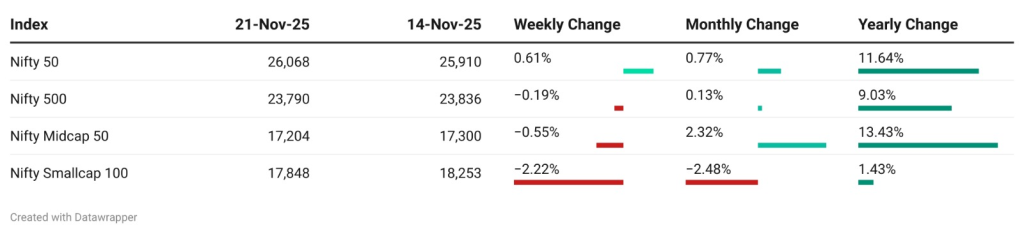

Chart Ki Baat

Gyaan Ki Baat

Markets Don’t Need a Nanny—They Need Transparency

The Lenskart IPO stirred up the usual storm online—sky-high valuations, promoters buying shares months earlier at a deep discount, and sudden profitability thanks to a one-time accounting entry. The outrage was loud, familiar… and partly misplaced.

Yes, the IPO looked expensive. Yes, retail investors should be cautious. But blaming SEBI for allowing an overpriced IPO misses the whole point of how markets are supposed to work.

A regulator’s job is transparency, not valuation. SEBI must ensure that every material detail—promoter transactions, financial history, risks, and red flags—is disclosed truthfully. It is not SEBI’s role to decide whether a company is worth investing in. Because once the regulator starts judging valuations, it stops being a watchdog and starts becoming an investment advisor—and that’s a slippery slope.

Think back to the 80s and 90s, when IPOs were filled with fabricated numbers, vanishing promoters, and zero accountability. That was real failure. Today, even the most overpriced IPOs come with detailed disclosures and enforceable accountability.

The truth is simple: the freedom to make good investment decisions also includes the freedom to make bad ones. If an IPO looks unattractive—skip it. But don’t expect the regulator to save you from your own choices.

Personal Finance

- Why buying health insurance should be your first move in personal finance: Health insurance is often treated as an afterthought, yet a single medical emergency can undo years of savings. With rising healthcare costs, early coverage has become the most essential starting point in personal finance. Read here

- How an 80-year-old widow won a 50-year fight for pension: 80-year-old widow wins justice after 50-year battle as High Court slams Haryana’s apathy and orders immediate pension relief. Read here

- How every day micro-payments eat into your savings: Have you ever wondered how many micropayment transactions we make each day? Micropayments through digital wallets such as Paytm, PhonePe, and Google Pay, often involving minimal amounts of money, have turned every phone into a frictionless payment device. It starts with a tap for chai, another for a quick ride, and one more for an app subscription. Read here

Investing

- The One Thing My Worst Investments Had in Common: He reveals how illiquid investments—from private equity to art fractions—became his biggest mistakes, trapping money for years with no escape. Read here

- Why All-Time Highs Matter in the Market: Data shows markets often surge after record highs—investors who panic miss gains, while those staying invested benefit from strong long-term momentum. Read here

Economy & Sector

- India looks for oil tankers to import Middle East crude ahead of sanctions deadline: A dozen vessels have been hired so far this week to ship crude from various Middle Eastern countries, including Saudi Arabia, Kuwait, Iraq and UAE. Read here

- India’s flash PMI falls to six-month low in November as manufacturing slumps: The Flash India Manufacturing PMI slumped to a nine-month low of 57.4 in November from 59.2 last month. Factory production growth recorded its weakest reading since May, with firms noting subdued intakes of new business. Read here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.