CAGR Insights is a weekly newsletter full of insights from around the world of the web.

What we’re reading this week

Domestic Investors Are Changing the Market Story – Read here

Sebi proposal could simplify withdrawals from demat mutual funds – Read here

Why India is resetting GDP and CPI base years and what the change means – Read here

US-India Trade Deal: A Game Changer or Political Gamble?

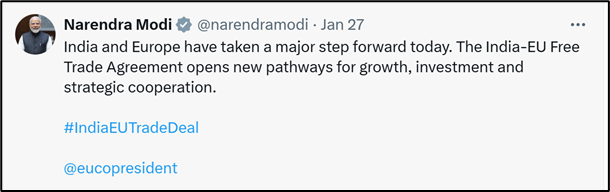

India signed two big trade agreements in just two weeks.

But they are quite different in their structure.

One is a full-fledged Free Trade Agreement (FTA) with the European Union—structured, rule-based, and built for the long haul.

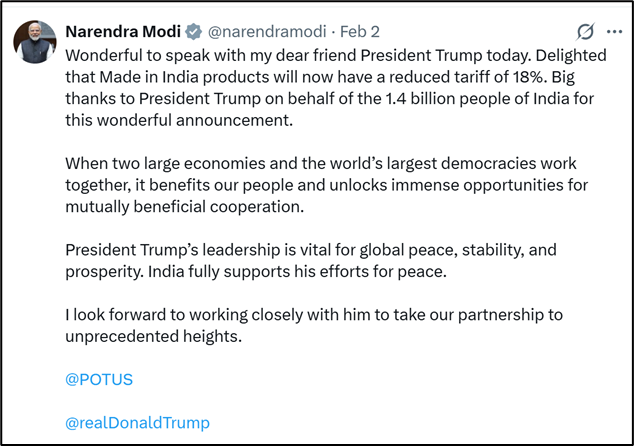

The other is a “deal” with the United States.

And that word—deal—changes everything.

And while we will talk about EU FTA deal in detail in our next newsletter, today we will focus on what the US “deal” means for us and our economy.

Unlike an FTA, the US–India arrangement doesn’t come with iron-clad institutional safeguards. It’s far more dependent on political sentiment. And when the dealmaker is Donald Trump, mood swings aren’t a footnote—they’re a risk factor. A single shift in narrative, and what’s agreed today can be questioned tomorrow.

So, before we celebrate both agreements in the same breath, it’s worth pausing. Because one of these is clearly not like the other.

But to understand where this deal might take us, we first need to rewind.

So, let’s go back to where it all started.

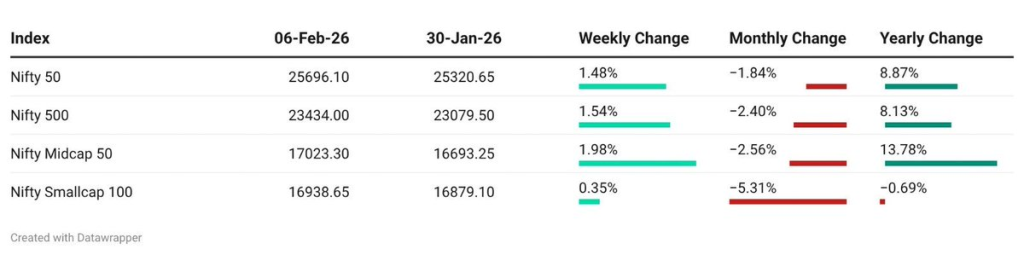

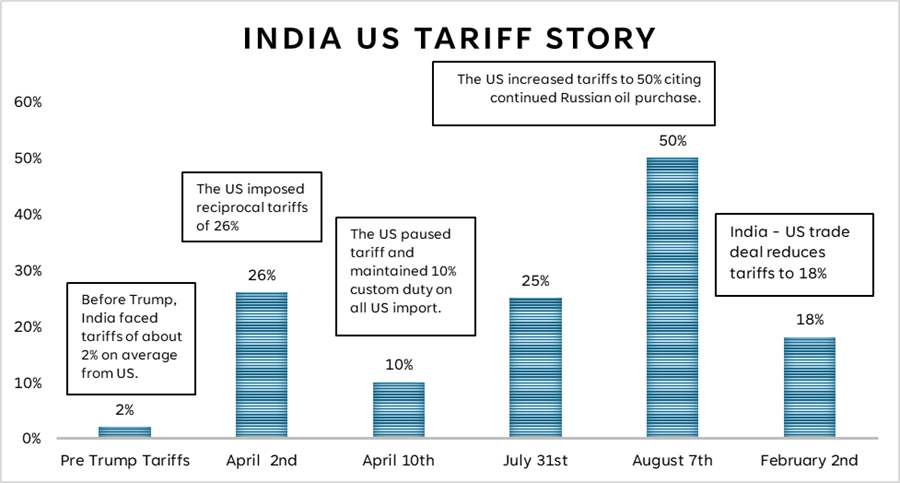

Table 1.1

The tariff dispute dates back to early 2025, when the Trump administration, pursuing a tough trade agenda, launched a series of tariffs under what it called “reciprocal tariff” policies aimed at reducing the US trade deficit with major partners.

This was the biggest overhang on Indian markets and with favorable outcome on this front, equity markets are poised for gains.

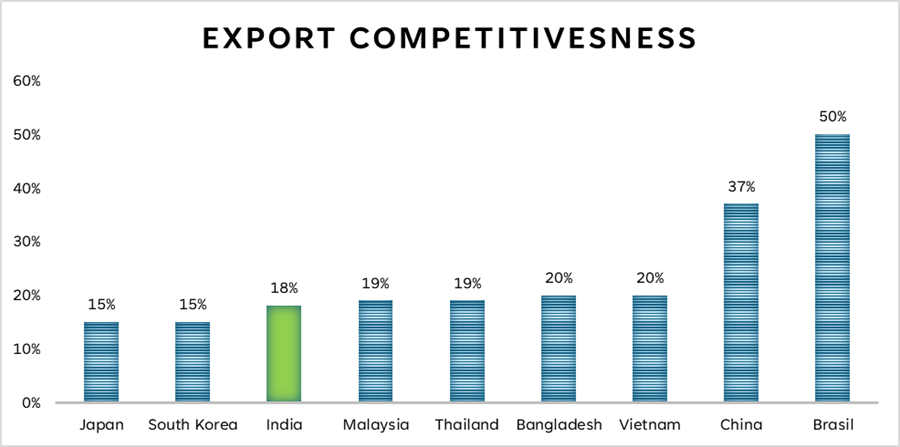

India now has a lower tariff rate than ASEAN countries. Most of them are stuck at 19%, with Vietnam at 20%. Further, China is subject to additional penalties for trans-shipment of Chinese goods. All of this together makes it competitively better for Indian exporters.

Table 1.2

It is perversely entertaining that 18% is now considered an awesomely “low” tariff rate given that we were at a very low rate till a few quarters before. But given the circumstances, this is nonetheless a boon to India.

Let us see why.

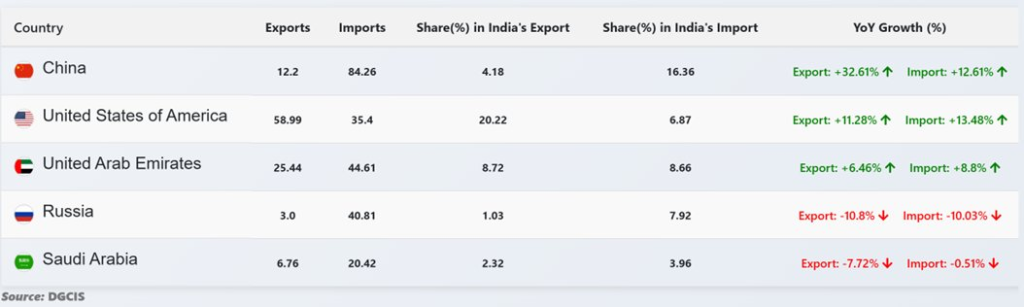

The US has been one of India’s most important export destinations for decades. In 2024-25, almost 20% of our exports went to the US (Table 1.1). And this is not just last year. Our exports to the US has always been a substantial portion of our exports (Table 1.2).

Against that backdrop, this deal marks a pivotal moment in India’s trade history.

Table 1.3

Table 1.4

If the deal holds—and if it survives Trump’s occasional policy frenzies—it could do more than just boost trade numbers. It may well act as the spark that reignites momentum in Indian equity markets, especially in sectors closely tied to exports and global demand.

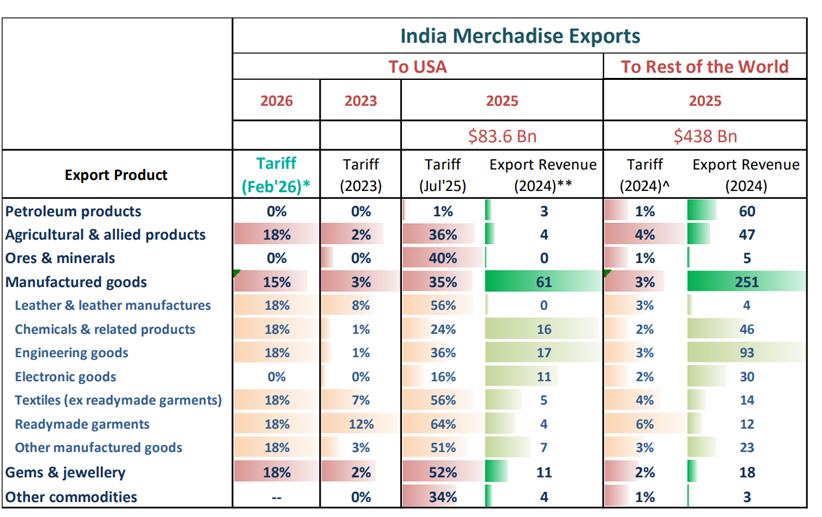

No official fact sheet has been released regarding the deal, but we have tried to analyze the sectoral impact of this deal.

Tariff relief, not normalization

Table 1.5

Feb’26 is a step-down from very high tariff of 2025. Peak US tariffs seen in Jul’25 (often 35% to 64%) have eased, but most key rates are still at 15% to 18%. We are still far from the “pre-Trump” rates and the question remains whether we reach there or not.

The US export basket is $83.6 bn, and manufactured goods alone are ~$61 bn, now facing a mid-teens tariff wall.

So what? Unless tariffs normalize further, we can expect margin pressure, price pass-through attempts, and export diversion away from the US, especially in labor-heavy categories (textiles, garments, leather, gems). More progress is needed on tariffs. Or, should we believe that the world trade order has permanently changed? Only time will tell.

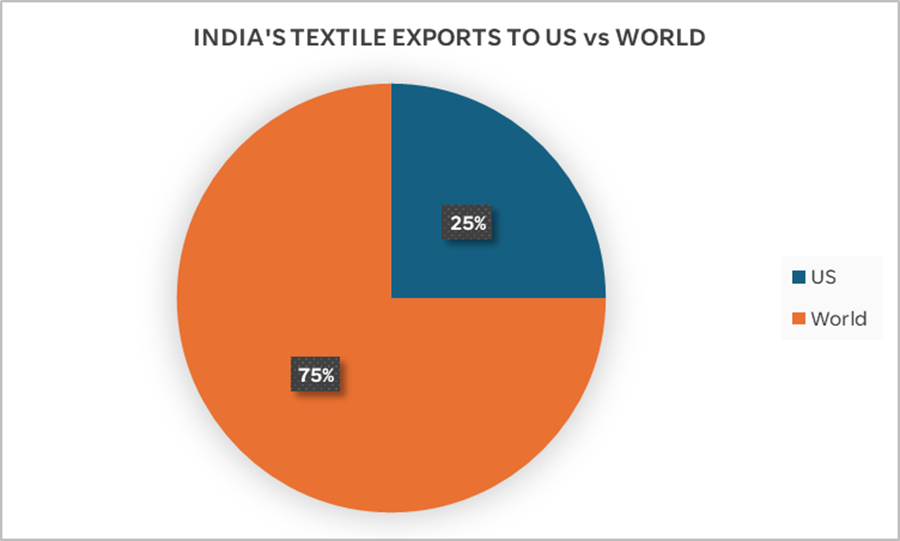

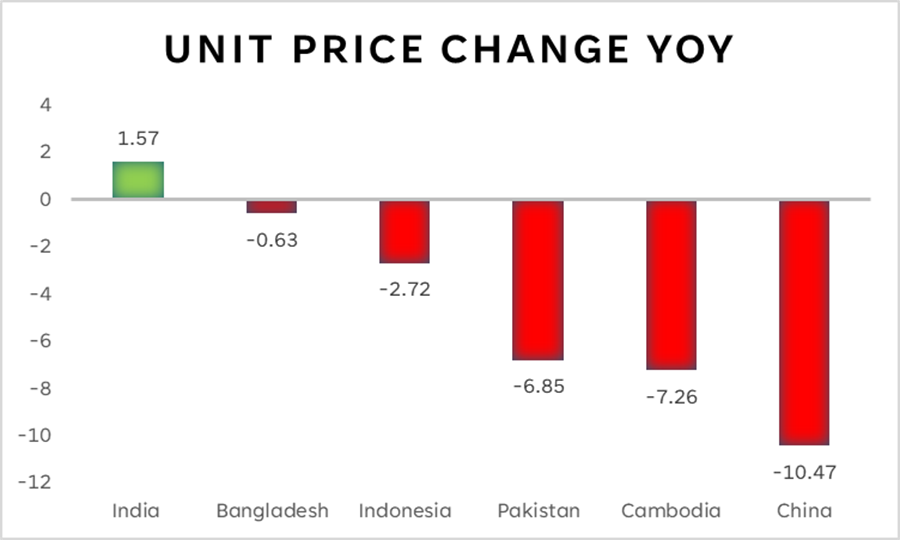

Textiles and Apparels

The textiles and apparel sector will face a great relief from the reduced US tariffs.

Table 2.1

Exports, including cotton garments and home textiles, from India face stiff competition from Bangladesh, Vietnam and other low-cost manufacturing hubs.

The reduced levy of 18% on Indian garments is less than the 20 per cent imposed by the US on Bangladesh or Sri Lanka. This could lead to textile orders returning to India after months of tariffs as high as 50% pushed some production to countries like Bangladesh.

Table 2.2

The below pricing data confirms that Bangladesh’s volume growth came at the expense of profitability. The country’s average unit prices fell 0.63%year-on-year, reflecting aggressive price concessions to secure rushed orders.

Table 2.3

Only India managed to post a price increase, suggesting comparatively stronger buyer confidence in its product mix, compliance positioning, and perceived value addition. Bangladesh, by contrast, joined the group of sourcing destinations trading margin for market share.

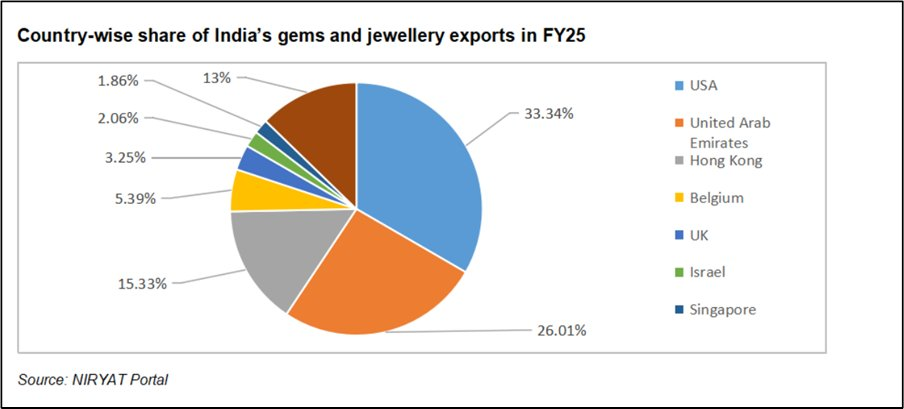

Gems and Jewelry

There is much to rejoice in India’s gems and jewelry sector. The US is its largest export market, accounting for about 30% of industry sales.

Table 3.1

In 2025, reciprocal U.S. tariffs disrupted trade flows to USA sharply. Duties on polished diamonds and colored gemstones surged from 0% to 10% in April, then to 50% by August.

This led to a 44.42% plunge in India’s gem and jewelry exports to the U.S. from April–December 2025 (US$ 8,691.25 million to US$ 3,862.08 million).

The tariff cut lowers costs for US importers, provides immense relief to diamond jewelry manufacturers enhancing the competitiveness of Indian diamond jewelry in the largest export market. This is poised to revive demand and stabilize operations.

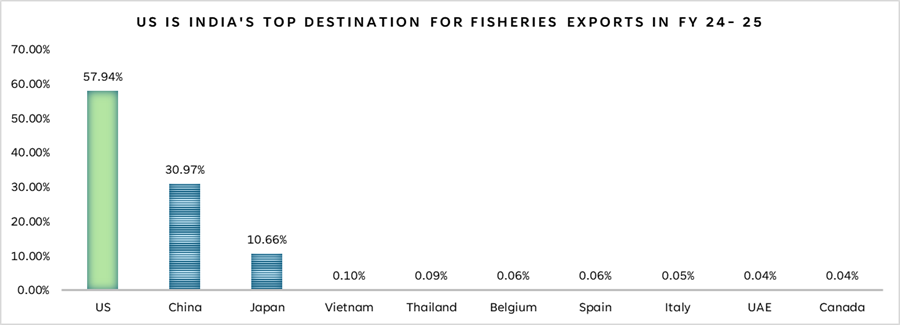

Seafood

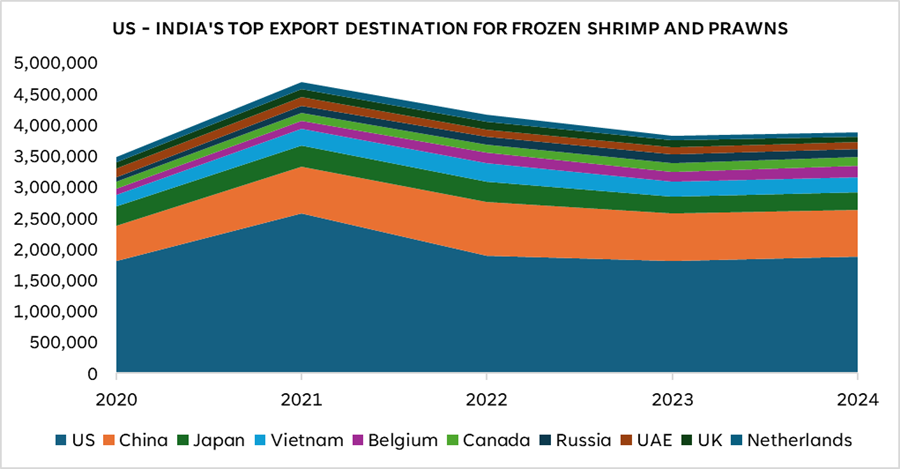

The seafood sector, especially shrimp and frozen food exporters, is highly dependent on the US market. With slashed taxes on Indian exports, seafood companies are likely to report improvement in earnings visibility and demand recovery.

Table 4.1

Table 4.2

Fish exports to the US fell 15% by volume to 201,501 tons in the April-November period of the current fiscal year, while value declined 6.3% to USD 1.72 billion from USD 1.84 billion a year earlier, SEAI General Secretary K N Raghavan said.

The decline came after the US imposed 50 per cent tariffs on Indian goods in August 2025 – the highest for any Asian country – including a 25% penalty linked to India’s purchase of Russian oil.

With the latest reduction, India is expected to compete more effectively with rival exporters such as Ecuador, Indonesia, Thailand and Vietnam.

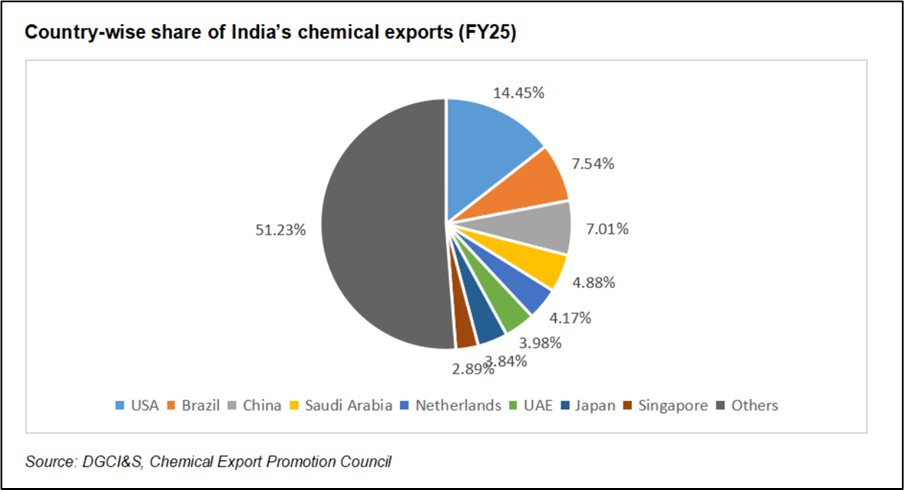

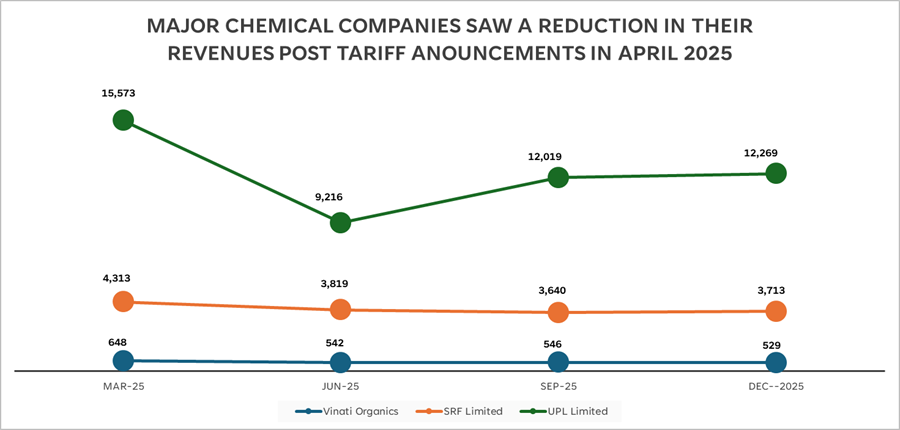

Chemicals

The Indian Chemical sector has been under pressure since last 2-3 years majorly due to global slowdown, Intense pricing pressure due Chinese competition, volatility in raw material prices and rising fixed costs. Besides this the sector witnessed incremental tariffs by US to ~50%.

Table 5.1

Table 5.2

We believe the recent announcement of tariff reduction is sectoral positive as the reduction in US tariffs to ~18% is likely to provide a level playing ground to India with other competitors such as China (47.5% tariff), South Korea, Japan, EU (15% tariff), Vietnam (20% tariff), Malaysia, Indonesia, Philippines (19% tariff).

But all is not good yet. Some sectors stay untouchable by tariff cuts, thanks to the powerful shield of US’ Section 232!

Section 232 of the Trade Expansion Act of 1962 is a U.S. law authorizing the President to impose tariffs or restrictions on imports if the Department of Commerce determines they threaten national security. It was created by Congress and signed into law by President John F. Kennedy.

The law’s main goal is to protect U.S. industries that are deemed essential for national security. If a product or material is important for the U.S. to maintain its defense, economy, or infrastructure, the government can act to make sure foreign competition does not harm those industries.

Who Gets Affected?

Products in industries like steel, aluminum, automobiles, timber, copper, and ships are often protected under Section 232 because they are considered vital for the country’s defense, infrastructure, and security. These sectors are seen as critical for making military equipment, building infrastructure like roads and bridges, or for other national security needs.

How It Works:

If there’s a threat to these industries from foreign imports (i.e., foreign countries are flooding the U.S. market with cheaper products that hurt local businesses), the U.S. government can impose tariffs (higher taxes) on these foreign goods to make them more expensive and less attractive to buy.

What this means for India?

- India too has exposure to sectors who fall under the Ambit of the Section 232 tariffs. According to available data, one-tenth of India’s exports or over $8 billion worth of exports may still face higher tariffs.

- Sectors that fall under the ambit of Section 232 include Automobiles, Steel, Aluminum, Timber, Copper and trucks & ships. They continue to remain under Section 232 due to national security reasons.

- According to the UN COMTRADE data, autos form the biggest exposure to this Section 232 with shipments worth nearly $4 billion falling under the national security lens. Steel exports were worth $2.5 billion, while Aluminum exports were close to $800 million. These sectors contribute to nearly 85% of total Indian exports which remain at risk under Section 232.

In conclusion, while the US–India trade “deal” offers promising benefits, particularly for sectors like textiles, gems, and seafood, it comes with a level of uncertainty due to its dependence on shifting political dynamics. Unlike the more structured EU agreement, the US deal’s success is intricately tied to the political climate, with the potential for sudden changes in trade policies. If the deal holds and the tariff reductions continue, it could revitalize key sectors of the Indian economy, especially in export-driven industries. However, for the deal to truly deliver long-term value, it will require political stability and continued efforts to address the remaining tariff challenges.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.