CAGR Insights is a weekly newsletter full of insights from around the world of the web.

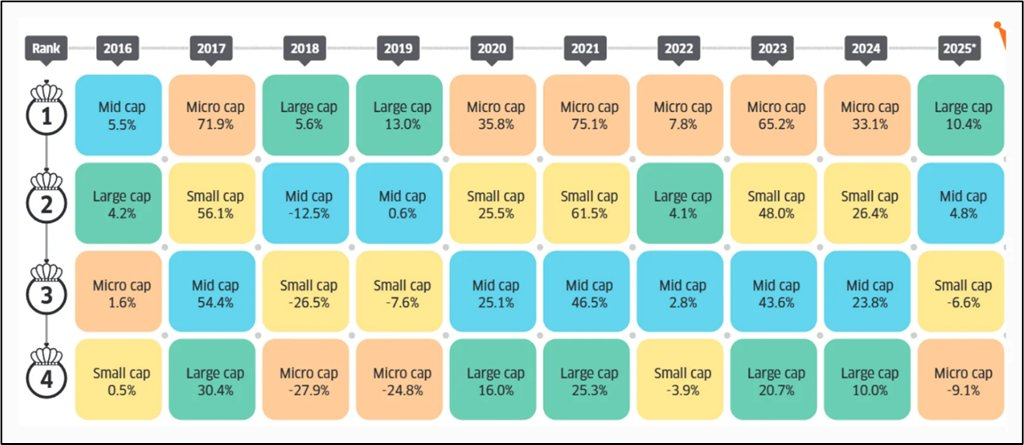

Chart Ki Baat

Gyaan Ki Baat

The Cost of Pausing When It Matters Most

If there’s one silent villain in wealth creation, it isn’t a bad fund, a bad year, or even a bad market.

It’s our own behaviour when markets fall.

We all love SIPs when markets rise. But the real test comes when everything around us looks uncertain. The irony?

The moments when we feel least comfortable investing are often the moments that build the most wealth.

Those six months you didn’t invest during Covid?

That was the market’s biggest “Buy One, Get One Free” sale in a decade — and fear talked you out of walking into the store.

Yes, your XIRR may look better on paper.

But wealth? Wealth is built by how many units you accumulate; not how heroic your return percentage appears.

Here’s the uncomfortable truth most investors learn late:

- Markets don’t reward perfection. They reward participation.

- Skipping SIPs during corrections feels safe now but costs you quietly for years.

- The best buying opportunities don’t announce themselves — they usually come disguised as crises.

Personal Finance

- Declutter your finances: A year-end money detox guide: To declutter your finances, start by gathering all financial documents, listing debts, and creating a budget. Automate payments, prioritize high-interest debts, and consider consolidating loan accounts. Read here

- India’s pension funds warn proposed bond rules may distort values: Indian pension fund executives are pushing back against a regulatory framework designed to shield the $175 billion sector from fluctuations in the bond market. This proposed shift in valuing specific bond assets has sparked concern among managers, who argue it risks misrepresenting fund worth and complicating investor decisions. Read here

- Do you really have to pay 84% tax on cash at home? Experts have clarified that you do not pay 84% tax just for holding cash at home. Read here

Investing

- My Favourite Investment Writing of 2025: With 2025 coming to an end, Nick Maggiuli has gathered his favorite investment writing of the year. Read here

- The Big Shift in Market Sectors Over 45 Years: When we look at long-term market data, one thing becomes very clear. Change never stops. Read here

Economy & Sector

- 7 ways AI can damage Indian economy if it clings to cheap manual labour? Without domestic investment in chips, AI platforms and robotics, India will import more hardware and core software. Read here

- How is Indian economy faring? We need right fundamentals for meaningful growth; India must modernise statistical architecture. Read here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.